June 17, 2020 Reading Time: 9 minutes

Reading Time: 9 min read

Image Credits: freepik

*Sandunika Hasangani

5G is no longer apolitical. ‘5G race’ is an already established term in international politics, reminding us of the ‘space race’ between the US and Soviet Union during the Cold War. 5G or simply the 5th generation wireless technology will transform every aspect of human life. This transformation will not only enable the existing Internet of Things (IoT), but also introduce millions of exciting new applications such as self-driving cars, buses, and trains, telesurgery which will connect surgeons and patients in great distances and smart home devices, public services, and smart city applications (i.e. smart water and sewage systems). By 2025 more than 6 billion, or 75% of the world’s population will interact with data every day, and each connected person will have at least one data interaction every 18 second.1 A recent report by World Economic Forum assesses that 5G networks will contribute 13.2 trillion USD in economic value globally and generate 22.3 million jobs from direct network investments and residual services.2 By 2025 Chinese datasphere will become the largest on earth compared to other regions such as Europe, the Middle east and Africa, U.S, and Asia Pacific, and Japan excluding China.3 There are also predictions that the coronavirus outbreak 4 and the rise of remote work will fast-forward 5G adoption.5 Given this context, this Policy Brief analyses the emerging techno-politics between 5G vendors and nation-states, and explores possible implications for smaller countries like Sri Lanka.

In mid-2019, the Trump administration banned US tech companies from using 5G telecommunication equipment that could be a threat to national security, and labelled Huawei a ‘high-risk-vendor.6 According to the US Department of State, Huawei is subsidized by China-for a reason, its actions are incompatible with democratic standards, and has a track record of spying, stealing, and supporting authoritarian regimes.7 Thus, for Washington, Chinese 5G is essentially a national security threat. Huawei naturally disagrees and has sued three critics in France for claiming that the company was a conduit for the Chinese Government to undertake espionage.8 More recently, irrespective of the US’s threat to limit the intelligence-sharing with Britain, the UK Prime Minister Boris Johnson allowed the Chinese manufacturer to participate in the UK’s next-generation cellular network9 (offering Huawei the non-core status), indicating that the UK is not yet a party to the US ‘anti-Huawei club.’ The European Union also takes a moderate path by not banning Huawei outright, but limiting and monitoring investments of ‘high-risk-vendors.’10 Given this, many speculate a drastic bifurcation of world politics on pro- and anti-Huawei lines, yet the 5G techno-politics are still maturing, limiting advanced predictions.

Figure 1: Huawei, by the Numbers11

In the face of pro- and anti-Huawei debate, it is worth answering the questions, ‘what consists of China’s Digital Silk Road?’ and ‘how big is China’s digital footprint?’ As per Mercator Institute for China Studies, the scope and ambitions of China’s digital strategy includes a variety of digital infrastructure projects from investment activity by Chinese tech giants, network equipment deals, smart projects implemented by Chinese companies, Chinese research and data centres, fibre optic cables, and various Memorandum of Understandings (MOUs).12

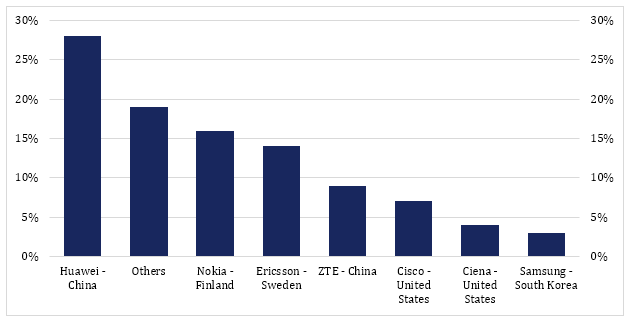

According to the data gathered by RWA Advisory Group (2012 and after), India, and Malaysia hosts the largest share of Chinese funded digital infrastructure projects . (Figure 2).13 Chinese companies are expanding their global footprint, installing fiber-optic/internet cables (in 76 countries), smart city initiatives (in 56 countries), telecommunication equipment (in 21 countries) ,and internet-connected appliances (in 27 countries).14 Led by Huawei, China’s global telecommunication market share is noticeably larger than other global counterparts such as Nokia, Ericsson, and Samsung. (Figure 3).

Figure 2: China’s Spending on Digital Silk Road Projects15

Note: Graph includes projects completed or initiated outside China since 2012 that enhance the digital infrastructure of the target country. Does not include merges or acquisitions. Dollar values for some projects are unavailable and therefore are not reflected in the country total.

Figure 3: Global Telecom Equipment Market Share (%) 201916

The enlargement of China’s digital footprint is marked with several key turning points. Made in China 2020 (MiC 2025) was launched in 2015 (and largely updated in 2017 as ‘Made in China 2025 Blue Paper’). This is the most comprehensive industrial strategy of China to date that emphasizes smart manufacturing, the digital transformation of all industries, self-reliance for core emerging technologies, and global leadership ambitions as a provider of tech products and services. In addition to that during the post-2017 period,China’s ambitious Digital Silk Road initiatives were well visible in a range of national-level policies such as ‘Cloud Computing Three Year Action Plan’ in 2017, ‘Digital Economy Development White Paper’, and also the ‘New Generation AI Development Plan’ in 2018.17

China has launched the ‘Belt and Road Digital Economy International Cooperation Initiative’ with Egypt, Laos, Saudi Arabia, Serbia, Thailand, Turkey, and the United Arab Emirates. It has signed cooperation agreements with 16 countries to strengthen the construction of the Digital Silk Road.18 As IMF working paper China’s Digital Economy: Opportunities and Risks reports, although China’s digitalization process lags behind some of the major economies such as the US, Japan, Britain, and South Korea, China has become a global leader in some key digital industries such as e-commerce (over 40% of global transactions), Fintech (Chinese companies account for more than 70% of the total global valuations), cloud computing, ICT exports, and also as a leading global investor in key digital technologies including big data, and artificial intelligence.19

Several mobile services providers have tested 5G in Sri Lanka. Yet, doubts and controversies exist among experts on many grounds. The first concern is whether 5G is a development priority of the country. According to the estimates of the Ministry of Telecommunication and Digital Infrastructure Facilities, developing 5G technology alone could account for 10% of Sri Lanka’s entire GDP by 2025, and generate over at least one million more jobs for years to come, and collectively add 8 billion to 20 billion USD in economic value by 2030 to Sri Lanka’s GDP.20

Secondly, some domestic telecommunication industrialists argue that Sri Lanka should not push aggressively to roll out 5G going by the hype it has created the world over, instead assessing what we can do with 5G that we cannot do with 4G is essential. According to them, about 98 percent of Sri Lanka’s e-commerce and e-government tasks can be executed with 4G and 5G is not yet in high demand.21 This is a concern that needs to be addressed with careful research and data.

The third controversy is whose technology is more secure? Huawei has already invested in Sri Lanka. Dialog Axiata22 and Mobitel23 conducted pre-commercial 5G trials during 2017-2019 and both Huawei and Ericson have partnered with them. Specifically, along with the existing anti-Huawei debate, it is likely that the other alternative 5G vendors offering attractive options for 5G infrastructure investments in the developing world. However, leveraging between perceived benefits and perceived security threats attached to each 5G vendor, along with domestic development priorities will be challenging but necessary.

Therefore, Sri Lanka needs to be equipped with a technologically clear rationale of either accepting or rejecting a certain 5G vendor. The Ministry of Digital Infrastructure and Information Technology has taken the lead and produced ‘National Digital Policy for Sri Lanka 2020-2025 (Draft 2.0)’ which provides some explanations. As the report specifies, the current telecommunications law that governs the sector needs to be upgraded to meet the requirements of the emerging 5G ecosystem. Broadcast and telecommunications sector regulationsare yet to converge to better manage the issues emerging from the above technological advancements.24

Currently, an integrated ‘5G Policy’ that initiate a discussion, and compiles recommendations and implementable solutions (similar to High Level 5G India 2020 Forum25 /5G white paper called ‘Enabling 5G in India26’ ), is a priority in Sri Lanka. Publishing a ‘whitelist’ of secure/trusted 5G vendors will also provide clarity for domestic service providers and for the general public, improving national laws and standards that every foreign 5G vendor must equally adhere to, and communicate those clearly to the general public will create a safer domestic 5G ecosystem.

5G is not a binary choice. As the Malaysian Minister of Communications has clearly stated, “we have our own safety standards, we have [our] own safety requirements. So, whoever deals with us, whoever comes up with proposals, we have to be certain and we have to be sure they meet the security standards that we have.”27 The Government of Malaysia is thus having multiple 5G agreements with several vendors such as Huawei, Nokia, and Ericsson. The rationale behind is to foster competition between vendors for a healthier sector. These are some of the areas that Sri Lanka needs to investigate more.

The global 5G market, vendors, their agendas and politics keep evolving unprecedentedly. Europe, South Asia, and Southeast Asia will remain battlegrounds for the evolution of the ‘5G race’ for the next couple of years. The US will reassess intelligence and information sharing with countries that welcome untrusted 5G vendors. Also, it is more likely that the competition between various 5G vendors will be heightened.28 Since technological advances are no longer apolitical, all the possible future decisions on above controversies will be subject to the technological ‘soft power politics’ played by great powers. Also, how technological ‘soft power’ could be transformed into ‘hard power’ game is another important concern for the survival of the smaller states like Sri Lanka. Therefore, Sri Lanka must carefully leverage the evolving 5G technology and politics to maximize the domestic economic and security interests.

1Reinsel, D., Gantz, J. & Rydning, J. (2018). The Digitization of the World – From Edge to Core. IDC White Paper: Framingham. [Online] Available at: https://www.seagate.com/in/en/our-story/data-age-2025/ [Accessed 27 February 2020].

2World Economic Forum. (2020). The Impact of 5G: Creating New Value across Industries and Society. [Online] Available at: http://www3.weforum.org/docs/WEF_The_Impact_of_5G_Report.pdf

[Accessed 5 April 2020].

3Supra note 1.

4Wasserman, T. (2020). Why the coronavirus pandemic may fast-forward 5G adoption in the US. [Online] CNBC-Tech Drivers. Available at: https://www.cnbc.com/2020/03/20/why-the-coronavirus-pandemic-may-fast-forward-5g-adoption-in-the-us.html [Accessed 20 April 2020].

5The term ‘Techno-politics’ is used here to refer to the ideas that ‘technological advances have political repercussions, technology have been increasingly politicized by states, and also Tec giants are becoming ‘political actors.’

6Stewart, H. & Sabbagh, D. (2020). UK Huawei decision appears to avert row with US. [Online] Available at: https://www.theguardian.com/technology/2020/jan/28/boris-johnson-gives-green-light-for-huawei-5g-infrastructure-role [Accessed 30 January 2020].

7The US Department of State. (2020 sic). 5G Security Factsheet -Huawei: Myth vs Fact. [Online] Available at: https://policystatic.state.gov/uploads/2019/12/5G-Myth_Fact4.pdf

[Accessed 20 January 2020].

8Hamilton, I. (2019). Huwawei is suing critics in France who said it spies for China. [Online] Business Insider. Available at: https://www.businessinsider.com/huawei-sues-france-critics-china-spying-accusations-2019-11 [Accessed 20 February 2020].

9Payne, S. & Manson, K. (2020). Donald Trump ‘apoplectic’ in call with Boris Johnson over Huawei. [Online] Financial Times. Available at: https://www.ft.com/content/a70f9506-48f1-11ea-aee2-9ddbdc86190d [Accessed 20 January 2020].

10Stevis-Gridneff, M. (2020). E.U. Recommends Limiting, but not banning, Huawei in 5G Rollout. [Online] The New York Times. Available at: https://www.nytimes.com/2020/01/29/world/europe/eu-huawei-5g.html [Accessed 2 February 2020].

11Maizland, L. & Chatzky, A. (2020). Huawei: China’s Controversial Tech Giant. Council on Foreign Relations. [Online] Available at: https://www.cfr.org/backgrounder/huawei-chinas-controversial-tech-giant [Accessed 20 April 2020].

12Shi-Kupfer, K. & Ohlberg, M. (2019). China’s Digital Rise: Challenges for Europe. Mercator Institute for China Studies: Berlin.

13Prasso, S. (2019). China’s Digital Silk Road is Looking more like an Iron Curtain. [Online] Bloomberg. Available at: https://www.bloomberg.com/news/features/2019-01-10/china-s-digital-silk-road-is-looking-more-like-an-iron-curtain [Accessed 20 January 2020].

14Ibid.

15Supra note 11.

16Dano, M. (2019). Huawei’s share of the Global Telecom Market Keeps Growing. LightReading. [Online] Available at: https://www.lightreading.com/market-research/huaweis-share-of-the-global-telecom-market-keeps-growing/d/d-id/753768 [Accessed 22 April 2020].

17Supra note 10.

18Belt and Road Portal. (2019). The Belt and Road Initiative Progress, Contributions and Prospects. [Online] Available at: https://eng.yidaiyilu.gov.cn/zchj/qwfb/86739.htm

[Accessed 15 January 2020].

19Zhang, L. & Chen, S. (2019). China’s Digital Economy: Opportunities and Risks. IMF Working Paper No.19/16 – International Monetary Fund. [Online] Available at: https://www.imf.org/en/Publications/WP/Issues/2019/01/17/Chinas-Digital-Economy-Opportunities-and-Risks-46459 [Accessed 3 March 2020].

20DailyFT. (2019). Sri Lanka foresees digitalization and 5G as ‘Energy Pill’ for economic growth: Harin. [Online] Available at: http://www.ft.lk/front-page/Sri-Lanka-foresee-digitalisation-and-5G-as–Energy-Pill–for-economic-growth–Harin/44-674440 [Accessed 8 February 2020].

21Jayasuriya, S. (2020). Is Sri Lanka ready for 5G? [Online] Sunday Observer. Available at: http://www.sundayobserver.lk/2020/03/01/business/lanka-ready-5g [Accessed 6 March 2020].

22Dialog. (2017). Dialog Axiata Trials 5G for the First Time in South Asia. [Online] Available at: https://www.dialog.lk/dialog-axiata-trials-5g-for-the-first-time-in-south-asia/

[Accessed 6 March 2020].

23Mobitel. (2019). Mobitel 5G Becomes the First and Fastest in South Asia. [Online] Available at: https://www.mobitel.lk/press-releases/mobitel-5g-becomes-the-first-and-fastest-in-south-asia [Accessed 2 April 2020].

24MDIIT & ICTA Sri Lanka. (2019). National Digital Policy for Sri Lanka (Draft 2.0). [Online] Available at: http://www.mdiit.gov.lk/index.php/en/component/jdownloads/send/6-legislation/76-national-digital-policy?option=com_jdownloads [Accessed 18 April 2020].

25Government of India. (2017). India Joins Race in 5G Ecosystem, Constitutes High Level Forum on 5G India 2020. Press Information Bureau, Ministry of Communications. [Online] Available at: https://pib.gov.in/newsite/mbErel.aspx?relid=171113 [Accessed 3 March 2020].

26Government of India (2019). National Digital Communications Policy 2018. Department of Telecommunications. [Online] Available at: https://main.trai.gov.in/sites/default/files/White_Paper_22022019_0.pdf [Accessed 3 march 2020].

27Barton, J. (2020). Malaysia holds 5G vendors to its own security standards. Developing Telecoms. [Online] Available at: https://www.developingtelecoms.com/telecom-business/vendor-news/9212-malaysia-holds-5g-vendors-to-its-own-security-standards.html [Accessed 8th April 2020].

28ShareAmerica. (2019). U.S. warns it won’t share intelligence with compromised partners.[Online] Available at: https://share.america.gov/u-s-wont-share-intelligence-with-compromised-partners/ [Accessed 3 February 2020].

*Sandunika Hasangani is a Research Fellow at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI) in Colombo. The opinions expressed in this piece are the author’s own and not the institutional views of LKI, and do not necessarily reflect the position of any other institution or individual with which the author is affiliated.