Sri Lanka-Singapore Free Trade Agreement

September 19, 2018 Reading Time: 8 minutes

Reading Time: 8 min read

Image credit: saiko3p/depositphotos

Divya Hundlani*

This LKI Explainer examines key aspects of the Sri Lanka Singapore Free Trade Agreement. It will also consider the future bilateral relations for Sri Lanka and the opportunities the Free Trade Agreement entails.

Contents

- Sri Lanka-Singapore Economic Relations

- Trade in Goods

- Trade in Services

- Trade in Specialised Goods and Services

- Investments

- Other Areas under the SLSFTA

- Conclusion

1. Sri Lanka–Singapore Economic Relations

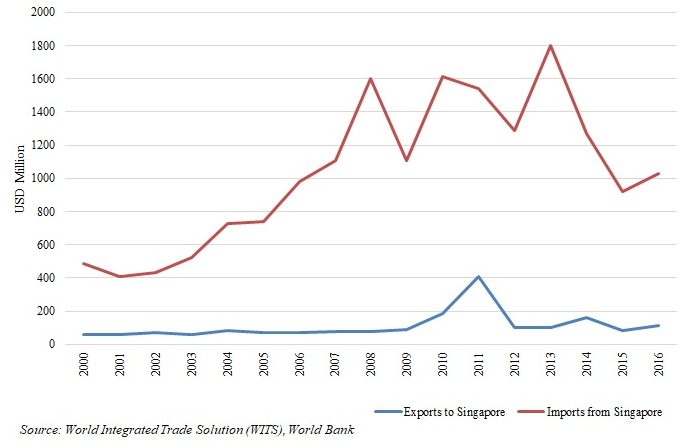

Figure 1: Sri Lanka’s Trade with Singapore

- Sri Lanka and Singapore have maintained economic ties since at least the 1970s. They had two main legal agreements prior to the 2018: the Avoidance of Double Taxation Agreement (DTA) and the Bilateral Investment Treaty (BIT).

- The DTA between Sri Lanka and Singapore was signed in 1979 and revised in 2014.10 The revised agreement lowers tax rates for dividends and royalties, and updates provisions for sharing tax information to meet international standards.11

- The BIT between Sri Lanka and Singapore came into force in 1980 and provides a foundation for promoting and protecting bilateral investments, outlining basic definitions of key terminology related to investment and trade.

- The Singapore–Sri Lanka Free Trade Agreement 2018 (SLSFTA)12 was signed in January 2018 after six rounds of negotiations beginning in July 2016,13 a relatively short period of negotiations compared to other FTAs of this nature.

- The SLSFTA is Sri Lanka’s sixth trading agreement14 and the first signed since 2005. By contrast, Singapore has over 20 agreements15 with bilateral and regional partners.

- The SLSFTA consists of 17 chapters and is the most comprehensive trade agreement Sri Lanka has signed to date.

2. Trade in Goods

- The agreement covers over 7000 tariff lines (product categories), 50% of which is custom duties eliminated immediately. Another 30% of tariff lines will be opened up over a 12-year period.

- Singapore is one of the most open economies in the world, with 99% of goods already entering Singapore duty-free16 prior to the FTA. The few items subject to tariffs include alcohol and tobacco products, motor vehicles, and petroleum products.

- Sri Lankan import taxes, including the Value Added Tax (VAT) and the Ports and Airport Levy (PAL), will be eliminated gradually.

- This provides Sri Lankan exporters with a long adjustment period of 15 years17 to adapt to new market conditions.

- A ‘negative list’ including 20% of tariff lines will be excluded from tariff reductions. Items on the negative list–notably petroleum products, alcohol, tobacco, and fishery and agricultural goods–are considered sensitive goods.

- Rules of Origin: All goods have to acquire at least 35% of their value addition domestically to qualify for duty-free access under the SLSFTA.

- This ensures that goods must be processed wholly in Singapore, or to have increased in value by a minimum of 35% in Singapore, to qualify as Singaporean goods and enter Sri Lanka duty-free.

- The agreement includes, however, product-specific rules that cover 1866 tariff lines for which there are more flexible rules of origin.

- The rules of origin prevent ‘third-party dumping’—goods from any third country entering the local market below market cost—which is an unfair trade practice that could harm local exporters.

- Trade Remedies: The SLSFTA outlines measures to counter dumping, identify subsidies and countervailing measures, and promote policies of cooperation and global safeguards.

- The chapter reaffirms Singapore’s and Sri Lanka’s commitment to Article VI of the General Agreement on Tariffs and Trade 1994, as well as to World Trade Organization (WTO) agreements on anti-dumping subsidies, countervailing measures, and global safeguards.

- It outlines bilateral safeguard measures to increase customs duties in Sri Lanka if Singaporean imports cause serious harm or injury to the domestic environment.

- Technical Barriers to Trade (TBT): The agreement includes a framework to prevent, identify and eliminate unnecessary TBTs, which are considered nontariff barriers. The TBTs of the SLSFTA includes adherence to international standards and technical regulations, and observation of transparency in trade in goods. International trading standards based on WTO guidelines are used as the basis for all technical standards that need to be set.

- Customs Procedures and Trade Facilitation: The SLSFTA includes simplified customs procedures and trade facilitation policies. Streamlined procedures aim to cut red tape, simplify adherence to competition law and technical standards, and reduce the cost of customs processing.

- Singapore’s single-window customs system is one of the best in the world. The system connects to all governmental agencies from which authorisation is required, shortening the approval time to 10 minutes or less in 99% of cases.18

- The SLSFTA requires Sri Lanka to maintain a single-window customs system, ensure the efficient clearance of goods, and minimise the documentation necessary for customs clearance.

3. Trade in Services

- One chapter in the SLSFTA liberalises several industries to facilitate trade in services. It provides commitment, transparency and certainty for Singaporean service suppliers operating in Sri Lanka.

- Trade in services was negotiated on a ‘positive list basis,’ requiring each state to specify sectors for liberalisation and the corresponding degree of openness.

- Some of Sri Lanka’s commitments include liberalising telecommunications services, including internet, mobile cellular and satellite services; computer-related hardware and software services; financial services covering insurance and banking; maritime services such as seaborne transport, repairs of seagoing vessels and cargo handling services; general construction services; and hotel, travel and tourism services.

- The SLSFTA covers consultancy and advisory services in sectors such as legal advisory for international and third-country law, but not for Sri Lankan law, advisory of architectural and engineering services, or management consultancy.

- Singapore’s commitments are more extensive and liberalise several sectors, including professional services, construction and engineering services, and goods distribution services.

- Movement of Natural Persons: The SLSFTA has come under discussiom in Sri Lanka for allegedly allowing Singaporeans to enter the local job market. However, the agreement strictly prohibits the free movement of natural persons (as opposed to such legal persons as corporations) under Article 7.2-4.19 The SLSFTA allows some controlled bilateral movement. Transferees within corporations are allowed but are limited to sectors liberalised in the SLSFTA and must be considered ‘specialists, managers or executives.’

4. Trade in specialised goods and services

- Some industries have been given individual chapters within the agreement, highlighting their importance to the economic development of Singapore and Sri Lanka.

- Electronic commerce: This chapter promotes consumer confidence in electronic trading by applying non-discriminatory policies to digital products. It also mitigates barriers to the use and development of digital products, provides personal data and consumer protection, and explores possible collaboration in information and communication technology. Singapore and Sri Lanka will continue to avoid imposing customs duties on electronic transmissions, based on a 2017 WTO decision.20

- Telecommunications: This chapter ensures access to and the use of public telecommunications services, provides safeguards against anticompetitive practices, and outlines processes for licensing and allocating frequency bands. It requires the telecommunications regulatory body in both countries to be an independent authority without any ties to public telecommunication providers.

- Sanitary and phytosanitary measures: This chapter aims to protect human, animal and plant life in both Singapore and Sri Lanka.

5. Investments

- The SLSFTA provides for transparent policies to guarantee investments and outlines frameworks to secure binding commitments over the long term.

- This provision includes investor protection under customary international law for minimum standards of treatment, ensures national treatment for partner investors and spells out in detail mechanisms to settle disputes between investors and governments.

- The chapter does not allow any preferential treatment for investors in Sri Lanka from members of the Association of Southeast Asian Nations (ASEAN), or investors in Singapore from members of the South Asian Association for Regional Cooperation.

- The focus of investment inflows is in manufacturing and services. Primary sectors such as agriculture, fisheries and forestry are, among others, protected from Singaporean investment.

- This chapter allows the Sri Lankan government to provide grants or subsidies to domestic institutions as an additional level of investor protection, on the basis of achieving national objectives.

6. Other Areas under the SLSFTA

- Government Procurement (GP): This is the first time Sri Lanka has included a GP chapter in an FTA, allowing Sri Lankan businesses to compete for Singaporean public sector contracts on an equal footing with local companies.

- GP policies follow International Competitive Bidding (ICB), which provides a wide choice in selecting the best bid from competing suppliers.

- GP is limited to seven selected central government entities and five state-owned entities in Sri Lanka. In Singapore, 24 central government and 19 state-owned entities are covered.

- The Sri Lankan government will continue to grant price preferences to domestic suppliers for a 10-year period.

- Competition: The chapter recognises the importance of operating in an environment with free and undistorted competition, and pledges cooperation and coordination in law enforcement related to bilateral trade relations.

- Intellectual Property (IP): A chapter provides for the protection and enforcement of IP rights, setting clear and common rules for both Sri Lanka and Singapore. Several international agreements and standards on IP rights must be followed, including the Protocol Relating to the Madrid Agreement Concerning the International Registration of Marks, the Patent Cooperation Treaty, and all well-known trademarks in accordance with the Trade-Related Aspects of Intellectual Property Rights Agreement, among others.

- Dispute settlement mechanisms: Any trade disputes between Singapore and Sri Lanka are to be referred to a dispute settlement panel that should address the dispute in 15–30 days and conclude the matter in 30–60 days. Alternatively, disputes can be solved through arbitration by a three-member panel whose decisions will be reached by consensus or majority vote. A final report is to be issued within 150 days of the establishment of the arbitration panel.

- General and Final Provisions Chapter: The chapter sets out a joint committee to review and advance trade relations. The committee is to meet every two years to monitor the use of the SLSFTA and consider mechanisms for further cooperation between Singapore and Sri Lanka.

7. Conclusion

- The SLSFTA is the first concrete outcome of Sri Lanka’s National Trade Policy of 2017, which emphasised FTAs with Asia and the West alongside unilateral trade liberalisation, trade facilitation and other measures. It is Sri Lanka’s first agreement in seven years and its most comprehensive trading agreement to date.

- The SLSFTA is a key vehicle to link Sri Lanka with East Asia.

- The agreement creates opportunities for Sri Lanka to increase inward investment flows and link to global value chains.

- Sri Lanka can potentially engage with the production value chains of 32 ASEAN members and partners, with whom Singapore already has FTAs.21

- The SLSFTA reinforces Sri Lanka–Singapore economic ties. Sri Lanka can now leverage Singaporean capabilities in areas like infrastructure development and urban planning to benefit local development.

Notes

1 World Integrated Trade Solution. (2018). Sri Lanka Trade Summary. Available at: https://wits.worldbank.org/CountryProfile/en/Country/LKA/Year/2016/TradeFlow/EXPIMP/Partner/SGP/Product/All-Groups.

2 Ibid.

3 International Trade Centre. (2018). Bilateral Trade between Sri Lanka and Singapore in 2016. Available at: https://www.trademap.org/Bilateral.aspx?nvpm=1|144||702||TOTAL|||2|1|1|1|1|1|1|1|1.

4 World Integrated Trade Solution. (2018). Sri Lanka Trade Summary. Available at: https://wits.worldbank.org/CountryProfile/en/Country/LKA/Year/LTST/Summary.

5 Global Edge. (2018). Sri Lanka: Trade Statistics. Available at: https://globaledge.msu.edu/countries/sri-lanka/tradestats.

6 World Integrated Trade Solution. (2018). Sri Lanka Product Exports and Imports from Singapore. Available at: https://wits.worldbank.org/CountryProfile/en/Country/LKA/Year/2016/TradeFlow/EXPIMP/Partner/SGP/Product/All-Groups.

7 International Trade Centre. (2018). Bilateral Trade between Sri Lanka and Singapore in 2016. Available at: https://www.trademap.org/Bilateral.aspx?nvpm=1|144||702||TOTAL|||2|1|1|2|1|1|1|1|1.

8 Central Bank of Sri Lanka (2018). Annual Report 2017. Available at: https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/annual_report/2017/en/14_Appendix.pdf.

9 Chia, Lianne. (2018). ‘The gateway to South Asia’: Singapore Businesses Set Up Shop in Sri Lanka. Available at: https://www.channelnewsasia.com/news/singapore/the-gateway-to-south-asia-singapore-businesses-set-up-shop-in-9885030#page=88.

10 Ibid.

11 Ministry of Development Strategies and International Trade Sri Lanka. (2016). Free Trade Agreement between the Democratic Socialist Republic of Sri Lanka and the Republic of Singapore. Available at http://modsit.gov.lk/32-uncategorised/115-free-trade-agreement-between-the-democratic-socialist-republic-of-sri-lanka-and-the-republic-of-singapore.html.

12 Ministry of Trade and Industry Singapore. (2016). Singapore and Sri Lanka Launch Negotiations for Free Trade Agreement. Available at: https://www.mti.gov.sg/NewsRoom/SiteAssets/Pages/Singapore-and-Sri-Lanka-launch-negotiations-for-Free-Trade-Agreement/Press release on launch of SLSFTA negotiations (Final).pdf.

13 Asia Regional Integration Center. (2017). Free Trade Agreements. Available at: https://aric.adb.org/database/fta.

14 Enterprise Singapore (2018). Singapore Free Trade Agreements. Available at: https://ie.enterprisesg.gov.sg/trade-from-singapore/international-agreements/free-trade-agreements/singapore-fta.

15 Export.gov. (2017). Singapore – Import Tariffs. Available at: https://www.export.gov/article?id=Singapore-Import-Tariffs.

16 Ministry of Development Strategies and International Trade Sri Lanka. (2018). Singapore and Sri Lanka FTA Annex 2A- Elimination of Customs Duties. Available at: http://www.modsit.gov.lk/images/pdf/free_trade_agareement/Chapter-02-2-NT-and-Market-Access-for-Goods—Annex-2-A—Elimination-of-Customs-Duties-General-Notes.pdf.

17 World Trade Organization. (2012). Singapore: Trade Policy Review. Available at: https://docs.wto.org/dol2fe/Pages/FE_Search/FE_S_S009-DP.aspx?language=E&CatalogueIdList=94584%2C34513%2C59727%2C84635%2C100463%2C92049%2C108594%2C45060%2C10123%2C24137&CurrentCatalogueIdIndex=0&FullTextSearch=.

18 Ministry of Development Strategies and International Trade Sri Lanka. (2016). Free Trade Agreement between the Democratic Socialist Republic of Sri Lanka and the Republic of Singapore-Chapter 7 Trade in Services. Available at: http://www.modsit.gov.lk/images/pdf/free_trade_agareement/Chapter-07-1-Trade-in-Services.pdf#page=4

19 World Trade Organization. (2017). Ministerial Ends with Decisions on Fish Subsidies, e-Commerce Duties; Ongoing Work Continues- 13 December 2017. Available at: https://www.wto.org/english/news_e/news17_e/mc11_13dec17_e.htm.

20 Enterprise Singapore (2018). Singapore Free Trade Agreements. Available at: https://ie.enterprisesg.gov.sg/Trade-From-Singapore/International-Agreements/free-trade-agreements/Singapore-FTA

Abbreviations

SLSFTA – Sri Lanka-Singapore Free Trade Agreement

DTA – Avoidance of Double Tax Agreement

BIT – Bilateral Investment Treaty

VAT – Value Added Tax

PAL – Ports Airport Levy

WTO – World Trade Organization

TBT – Technical Barriers to Trade

ASEAN – Association of South East Asian Nations

*Divya Hundlani is a Research Fellow at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI). The opinions expressed in this article are the author’s own views. They are not the institutional views of LKI, and do not necessarily represent or reflect the position of any other institution or individual with which the authors are affiliated.