January 7, 2021 Reading Time: 22 minutes

Reading Time: 22 min read

* Nikhita Panwar

Bangladesh emerged as a sovereign country in 1971. Ever since, Sri Lanka and Bangladesh have deepened bilateral relations and extended economic and diplomatic ties with one another in a close to 50-year period. As significant South Asian economies, both countries share similarities founded in their Commonwealth history, which has led them to part take in a series of multilateral platforms such as the South Asian Association for Regional Cooperation (SAARC) and the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC), which has allowed both countries to foster engagement.

Parallel to Bangladesh’s own economic growth in recent years, there has been an increase in diplomatic and economic cooperation between the two countries, reflected in a surge in bilateral trade, the signing of multiple Memoranda of Understanding (MoU) and joint initiatives to increase connectivity. That said, there is still potential to further deepen existing ties by actively pursuing proposed bilateral agreements and focusing on strengthening cooperation in key sectors, such as the garment and shipping industries.

This LKI Policy Brief explores the current relationship shared by Sri Lanka and Bangladesh with a focus on economic ties. It highlights areas where economic linkages can be strengthened and offers associated policy suggestions.

Bangladesh is a significant and rapidly growing economy in South Asia. With a population of 163 million and a GDP of USD 278.2 billion1 it is the third largest market and the third largest economy in the region. In 2019, Bangladesh’s GDP growth rate of 8.2% made it the fifth fastest growing economy in the world and the quickest expanding economy in the South Asian region.2 Given its progress in key thematic areas such as energy, infrastructure, urbanisation, human capital, and technology, Bangladesh has been identified as a ‘Next Eleven’ country by Goldman Sachs in 2005, indicating that it is one of 11 high-potential, emerging economies after Brazil, Russia, India, China, and South Africa (BRICS).3

Bangladesh has undergone significant transformations over the years, tackling development issues – including famine and poverty – that were once considered characteristic of the country. Bangladesh emerged as an independent country following two violent partitions – first from India in 1947 and subsequently from Pakistan in 1971. Following the second partition, Bangladesh’s economy contracted severely, experiencing a 14% decline in GDP growth.4 In the mid-1970s and 1980s, under the 19-Point Program5 Bangladesh began to gradually increase privatization, encouraging private investment, controlling population growth, and working towards self-sufficiency in food production through agricultural development.

Bangladesh’s national agenda to industrialize led to an increased emphasis on the textile industry. Over time, Bangladesh’s textile and garment industry has developed into the country’s backbone, accounting for 84.0% of Bangladesh’s exports and 11.2% of the country’s GDP in 2019.6 In 2019, Bangladesh was the third largest exporter of clothing globally, accounting for 6.8% of global garment exports.7

Through Bangladesh’s economic expansion, a rise in employment in the manufacturing sector and the associated increase in incomes, the country’s poverty rate declined from 25.7% to 14.8% (2016)8 in a little more than 10 years.9 What is more, per capita incomes rose 16-fold between 2009 and 2019,10 leading Bangladesh to graduate to a ‘Lower Middle Income’ country in 2015.11

LKI illustration based on various sources.

As a result of the COVID-19 pandemic, Bangladesh’s 2020 GDP growth rate is forecasted by the Asian Development Bank (ADB) to fall to 4.5%, and bounce back to 7.5% in 2021.12 Other predictions are slightly less optimistic, with the IMF projecting Bangladesh’s GDP growth at 3.8% in 2020.13 That said, the impact of COVID-19 is not expected to be as pronounced relative to other countries. Emerging and developing economies are expected to contract at -1% in 2020 (0.1% for developing Asia),14 while advanced economies face even lower predictions of -6.5%.15 This is a strong positive indication that Sri Lanka-Bangladesh trade and investments relations have the potential to advance even under current circumstances.

Thus far, Sri Lanka has been able to largely contain the COVID-19 impact and is in a position to focus on economic recovery, which can jointly be achieved through deeper cooperation with Bangladesh. As an economy with a positive growth projection, Bangladesh offers significant market potential to Sri Lankan businesses. Certain areas can be focused upon when looking to foster deeper cooperation. For instance, bilateral trade, which is currently limited, can be bolstered through the formalization of a Free Trade Agreements (FTA). Linkages in the textile industry can be deepened to attract more business from key western markets. Sri Lanka’s already existing strong maritime links to both Bangladesh and western markets, in addition to Sri Lanka’s global competitive positioning in terms of its port connectivity, can additionally be leveraged to extend shipping services to Bangladesh, leading to increased connectivity and economic integration.

As the 50-year anniversary of bilateral relations approaches, during a time characterised by major global supply chain shifts brought on by the COVID-19 pandemic, there is an opportunity for Sri Lanka and Bangladesh to take stock of existing relations and assess ways to reinforce ties.

3.1 Diplomatic Ties

Diplomatic relations between Sri Lanka and Bangladesh were officially established in 1972, following Bangladesh’s independence. Sri Lanka has two permanent missions in Bangladesh – a high commission in Dhaka and an honorary consulate in Chittagong,16 whilst Bangladesh maintains a high commission in Colombo.17

Relations between both countries have been marked by several high-level state visits that have helped to deepen bilateral cooperation. During former President Maithripala Sirisena’s three-day visit to Bangladesh in 2017, 14 MoUs were signed in a range of different sectors with the intention to increase bilateral cooperation. Among these was an MoU for cooperation in the field of international and strategic studies, between the Bangladesh Institute of International and Strategic Studies and the Lakshman Kadirgamar Institute of International Relations and Strategic Studies and an MoU between the Bangladesh Foreign Service Academy, and the Bandaranaike Diplomatic Training Institute,18 signifying the reinforcement of diplomatic ties and collaboration. MoUs in other sectors include pharmaceuticals, shipping, information technology, agriculture, investment, banking, tourism, and media.

Gestures of goodwill with regards to shared religious beliefs have also served to build meaningful linkages, such as Bangladesh’s donation of the Buddha’s hair relic upon request of the Sri Lankan government in 200719 and the donation of 30 Buddha statues from Sri Lanka to Bangladesh’s reconstructed Ramu Temple in 2015.20

Sri Lanka and Bangladesh also participate in several multilateral platforms that promote intra-regional ties within the South Asian region and have recently seen an increase in activity and cooperation due to COVID-19. (Box 1).

Box 1 – Bilateral Interaction within Regional Platforms

Sri Lanka and Bangladesh share membership of several multilateral organizations including the SAARC, BIMSTEC, and the Indian Ocean Rim Association (IORA). These organizations serve as platforms upon which regional and bilateral cooperation between Sri Lanka and Bangladesh can be built upon.

Following the COVID-19 outbreak, there has been renewed interest and dialogue between nations through these organizations, particularly SAARC. SAARC state leaders and health officials convened virtually in March to identify cooperative measures to mitigate the spread and economic impact of COVID-19 in the region. A SAARC emergency COVID-19 fund was established to which each member state made contributions. Sri Lanka and Bangladesh contributed USD 5 million and USD 1.5 million respectively.

BIMSTEC focuses on cross-border sector-specific cooperation in 14 subsectors. Sri Lanka is the current chair of BIMSTEC and the lead country of the technology subsector. Bangladesh leads two subsectors, namely trade and investment, and climate change.21 The countries’ positions in the organization can be utilized to identify and facilitate cooperation in either country’s respective subsectors. There is an upcoming opportunity for dialogue in this regard as Sri Lanka prepares to host the BIMSTEC summit in due course, which will be the first BIMSTEC event Sri Lanka will host under the new administration.22

IORA aims to promote the liberalization of trade and invest, and drive cooperation among member states for maximum and mutual benefit. Last year, the former Minister of Foreign Affairs, Tilak Marapana, attended the third IORA Blue Economy Conference in Dhaka. During the conference the Minister engaged in bilateral discussions with Bangladesh and highlighted Sri Lanka’s vision to develop itself as a logistical hub in the Indian Ocean, with the aim to enhance connectivity among global supply chains.23 Pursuing this dialogue with Bangladesh will be worthwhile to increase bilateral maritime cooperation.

3.2 Economic Ties

Over time, the countries’ shared economic partnership – including trade and investment – has deepened. Since 2006, the Sri Lanka-Bangladesh Chamber of Commerce and Industry (SLBCCI), serves to promote trade and investment between the two countries.24 Sri Lanka and Bangladesh’s economic engagement is also reflected in the aforementioned series of MoUs. Among these is a MoU on Economic Partnership, which was initially intended to “pave way for conclusion of the Free Trade Agreement (FTA) by end-2017”.25 Although a joint feasibility study for an FTA was conducted in 2018,26 both countries currently do not share a trade agreement.

Trade

Despite the absence of a bilateral FTA, merchandise trade increased nearly 100-fold in absolute terms during the past two decades. (Figure 1).27 However, there is much room for bilateral trade relations to be deepened with regards to interactions under existing regional trade deals. (Box 2).

Box 2 – Bilateral Interaction under Regional Trade Agreements

Sri Lanka and Bangladesh are both members of regional multilateral trade agreements, namely the Asia-Pacific Trade Agreement (APTA), signed in 1975 and the South Asian Free Trade Area (SAFTA), which came into effect in 2006. Bangladesh is Sri Lanka’s second largest trading partner under SAFTA, following India. However, trade under SAFTA as a share of total trade between the two countries is limited, accounting for 7.3% of exports from Sri Lanka to Bangladesh and 2.2% of imports from Bangladesh in 2019.28 Under both agreements Sri Lanka grants additional concessions to Bangladesh as a Least Developed Country (LDCs), which will however change once Bangladesh graduates from LDC status (envisaged for 2024, subject to Bangladesh meeting requirements in 2021).29

Under SAFTA, members maintain a sensitive list of products, which don’t qualify for tariff reductions. As an LDC, Bangladesh benefits from a shorter sensitive list and additional tariff lines that Sri Lanka provides zero duties or a margin of preference over, which cover a majority of agricultural and industrial sectors.

Trade under APTA is much lower, representing 0.6% of exports from Sri Lanka to Bangladesh and 0.1% of imports from Bangladesh in 2019.30 Preferences all members under APTA cover tariff lines for industrial products, machinery, wood, and steel products, while the added concessions for LDCs cover mostly textile goods. 31

The absolute value of exports from Sri Lanka to Bangladesh increased from USD 10 million in 2000 to a peak of USD 133 million in 2018 (Figure 1), quadrupling Sri Lanka’s exports to Bangladesh as a share of its total exports from 0.2% to 0.6%. (Figure 2).32 In 2019, a dip in exports to Bangladesh occurred, which was concurrent with a decline in Sri Lanka’s overall exports. Sri Lankan imports from Bangladesh have risen at a slower rate from USD 4 million in 2000 to USD 37 million in 2019. (Figure 1).

Figure 1: Sri Lanka-Bangladesh Merchandise Trade, 2000 – 2019 (Millions USD)

Source: IMF (2020).

Note: Exports are measured on freight on board (FOB) basis and imports are measured on cost, insurance, freight (CIF) basis.

Sri Lanka’s trade with Bangladesh relative to total trade is limited, accounting for less than 0.6% of Sri Lanka’s total exports and 0.3% of total imports, respectively in 2019. (Figure 2).33 This is quite low compared to other trade partners in the region, such as India, which accounted for 6.7% of exports and 16.6% of imports. Nevertheless, the Bangladeshi market is important for Sri Lanka. In 2019, Bangladesh was Sri Lanka’s 20th largest export market globally and the 2nd largest export market within the South Asian region, following India.34 In terms of imports this significance was less prominent, with Bangladesh ranking Sri Lanka’s 42nd largest market globally and 5th largest market regionally.35

Figure 2: Sri Lanka’s Merchandise Trade with Bangladesh, 2000 – 2019 (% of Total Trade)

LKI calculations based on IMF (2020).

Note: Exports are measured on freight on board (FOB) basis and imports are measured on cost, insurance, freight (CIF) basis.

The composition of Sri Lanka’s export basket with Bangladesh has shifted since 2000, from primarily including animal and vegetable fats, plastics, and manufactured filaments or textiles, to cotton, staple fibres, apparel and accessories, and knitted textiles – indicating increased linkages between either countries’ garment sectors.36 In 2017,37 Bangladesh was Sri Lanka’s largest export market for cotton, accounting for 65.5% of Sri Lanka’s cotton exports.

Sri Lanka’s import basket has changed from consisting mostly of fabrics and cotton, to machinery and vegetables. A key import item that remained is pharmaceutical products, which is currently Sri Lanka’s most imported good from Bangladesh.38

On an absolute basis, Bangladeshi exports to Sri Lanka are comparatively small, which is partly owed to Sri Lanka’s limited market size. On a relative basis, neither Bangladesh’s exports to nor imports from Sri Lanka as a share of total trade have seen a marked increase between 2000 and 2019, on average accounting for 0.05% and 0.1% per annum, respectively. (Figure 3).

Figure 3: Bangladesh’s Merchandise Trade with Sri Lanka, 2000 – 2019 (% of Total Trade)

LKI calculations based on IMF (2020).

Note: Exports are measured on freight on board (FOB) basis and imports are measured on cost, insurance, freight (CIF) basis.

Garment Sector

Both countries share similar experiences of having a strong, export-oriented garment sector, for which this sector requires special attention. Linkages between the countries’ sectors are strong, based on historical and current cooperation, and can be leveraged. In current circumstances, as the global garment industry copes with challenges posed by the COVID-19 pandemic and as global supply chains shift to reduce their reliance on China, strengthened regional cooperation in the garment industry would be instrumental in minimizing losses.

Bangladeshi and Sri Lankan manufacturers have often collaborated in the garment production process. Focusing on their own comparative advantages, Bangladeshi manufacturers (benefiting from lower wage costs) produce basic garments, and subsequently transport to Sri Lanka for value-addition and finishing (benefiting from higher skilled labour, design capabilities, and equipment)39 before shipping the final product to western markets.40 An MoU was signed in January 2020 between Sri Lanka’s Joint Apparel Association Forum (JAAF) and the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) “to promote bilateral businesses and enhance cooperation in the field of production, trade, commerce and research related to the textile and garment industry”.41

Despite strong links, the textile sector is one of the few sectors that Bangladesh does not allow 100% FDI into. Sri Lankan manufacturers have therefore called for the liberalization of Bangladesh’s FDI policy in the textile sector. 42

Due to the COVID-19 pandemic both countries have incurred high health and economic costs. An example of this are the significant losses incurred by the garment industry. The majority of garment orders from Bangladesh were cancelled in April 2020, noting an 85% decline compared to April 2019.43 Meanwhile, Sri Lanka’s exports in textiles and clothing are forecasted to decline by 30% in the 2021 fiscal year.44

Maritime Connectivity

In addition to manufacturing links, there are also possibilities for enhanced maritime connectivity. The Bangladesh Shipping Corporation and the Ceylon Shipping Corporation share an MoU, focusing on increasing the frequency of feeder services and providing priority berthing and tariff concession at the Chittagong and Colombo seaports.45 There have been efforts to further enhance maritime links through a Coastal Shipping Agreement, which is currently pending.

Maritime connectivity between the countries is reflected in their higher liner shipping bilateral connectivity index (LSBCI), which serves as an indicator of a country pair’s maritime connectivity. With an LSBCI of 0.291, Sri Lanka ranks as the 7th most well connected country globally, and the most well connected within the South Asian region, to Bangladesh in terms of shipping.

Sri Lanka’s strategic location on major shipping routes in the Indian Ocean allows better access and connectivity to key markets than Bangladesh does. LSBCI between Sri Lanka and markets such as the UK, Europe, China and India, is higher than the LSBCI between these markets and Bangladesh, indicating better maritime connectivity. Due to this, harbour and shipping fees in Sri Lanka are lower, resulting in lower overall transportation costs. For example, container freight from Sri Lanka to Japan is approximately 40% cheaper than from Bangladesh to Japan.46 Sri Lankan ports are also closer to key western markets than Bangladesh’s Chittagong port and are two weeks ahead in lead time.47

Tourism

Despite the countries’ proximity and Sri Lanka being internationally recognised as a top travel destination, inbound tourism from Bangladesh is limited. In 2019, tourist arrivals from Bangladesh stood at 8,261, accounting for only 0.4% of total tourist arrivals.48 Between 2014 and 2019, Sri Lanka has seen low numbers of tourist arrivals from Bangladesh, on average accounting for only 0.6% of total incoming tourists. Information on outbound tourism from Bangladesh is scarce. However, the World Bank reports that Sri Lanka received only 0.6% of outbound tourism from Bangladesh (2013),49 indicating that there is a lot of potential for Sri Lanka to attract tourists from Bangladesh.

Investment

Bangladesh has actively pursued creating a conducive environment to attract investment. Its investment framework allows several benefits including legal protection for foreign investments, repatriation of profits and non-discriminatory treatment between foreign and local investments, tax holidays for up to 15 years,50 and agreements to avoid double taxation with 28 countries including Sri Lanka.51

Due to wide-ranging benefits, Sri Lankan investor interest in Bangladesh has increased over the years. While the two countries do not share a Bilateral Investment Treaty (BIT) yet, an MoU between the Bangladesh Investment Development Authority and the Board of Investment of Sri Lanka was signed in 2017,52 indicating either country’s commitment to cooperating in investment matters. The introduction of a BIT would be beneficial to reinforce existing economic linkages and particularly for increasing limited investor interest from Bangladeshi firms.

Investment from Sri Lanka has seen a strong increase in the last two decades. Sri Lanka’s FDI to Bangladesh rose from USD 0.67 million in 2000 to USD 329 million in 2019, representing 1.9% of total foreign investments in Bangladesh, making Sri Lanka one of the top 15 sources of inward FDI stock.53 In 2017, Bangladesh was the third largest recipient of Sri Lankan investment, receiving 12.0% of Sri Lanka’s total FDI outflows.54 Sri Lankan investments are primarily targeted at the banking sector, making up 7% of sectoral FDI stock, followed by the power, and textile and apparel sectors.

Figure 4: Sri Lanka’s FDI stock in Bangladesh by sector, 2019 (% of Sri Lanka’s total FDI stock in Bangladesh)

LKI calculations based on Bangladesh Investment Development Authority (2020).

Sri Lankan investors appear more inclined to invest overseas than Bangladeshi investors. Bangladesh’s total outward FDI stock as a share of GDP in 2019 was 0.5% (Sri Lanka: 1.8%).55 Historically, Bangladeshi outward investment has been limited due to government restrictions and a focus on domestic capital development. Outward investment policies were only liberalized in 2015, after which there was an increase in proposals for overseas expansion from Bangladeshi firms,56 which more than doubled FDI outflows between 2015 and 2017.57 The Nikkei Asian Review reports that approval for significant investments is conditional upon continuing employment requirements in Bangladesh and the ability to repatriate overseas profits.58 As of 2014, only six Bangladeshi firms had invested only approximately USD20 million in Sri Lanka, primarily in the pharmaceutical sector.59

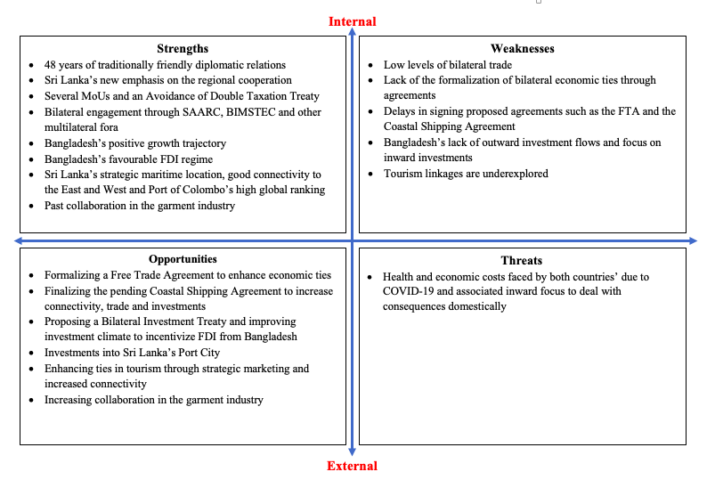

Although Sri Lanka and Bangladesh share friendly bilateral relations and have in the past engaged in initiatives to enhance their partnership, there is unrealised potential to be capitalized upon. A Strengths, Weaknesses, Opportunities, & Threats (SWOT) analysis is a useful tool to summarize and assess key factors of Sri Lanka – Bangladesh relations and aspects that can be leveraged to reinforce bilateral relations. (Figure 5).

Figure 5: SWOT-Analysis of Sri Lanka-Bangladesh Ties

LKI illustration based on various sources.

LKI illustration based on various sources.

4.1 Strengths and Opportunities

A key strength of Sri Lanka-Bangladesh relations lies in the traditionally friendly diplomatic ties both countries have shared for nearly 50 years. Cooperation is reflected in several MoUs and an Avoidance of Double Taxation Treaty. Their bilateral engagement has been deepened by cooperating in multiple multilateral fora. Previously established manufacturing links and joint production processes between the countries’ textile sectors additionally represent a strength of Sri Lanka – Bangladesh economic ties.

Individual advantages of the two countries also further lend themselves as strengths to their shared bilateral relations. Bangladesh’s successful economic growth and development story has allowed trade and economic engagement with Sri Lanka to consistently increase. Furthermore, Bangladesh’s liberal investment policies that have encouraged Sri Lankan firms to create a presence in a range of sectors in the Bangladeshi economy also lay the foundation for increased investor interest in the future.

Sri Lanka’s key strengths lie with the country’s maritime advantages, particularly the Port of Colombo as an emerging maritime hub. It is well connected with over 100 countries and is ranked 24th in the world (1st in the South Asian region) based on its annual throughput of twenty-foot equivalent units (TEUs).60 Sri Lanka’s port development strategically positions the country as a hub for multi-country consolidation (MCC) services, which involves optimizing cargo from multiple origins by consolidating less-than-container shipments to build full container loads, before shipping them to their destination.61 By doing so, Sri Lanka as an MCC hub could provide flexible, efficient services, and competitive shipping fees to large and SME firms in Bangladesh.

Sri Lanka and Bangladesh can leverage on their geographical proximity and established shipping connectivity.62 Sri Lanka is also better connected to key markets, in terms of LSBCI. Capitalizing on this strong maritime connectivity could yield reduced transhipment time and cost for both Sri Lanka and Bangladesh. Although there has been some initiative to deepen these ties, through the MoU between the shipping sectors, there are also opportunities for Bangladesh to invest into Sri Lanka’s ports and logistical hubs, such as the Hambantota industrial zone. This could be a particularly attractive opportunity as the Hambantota port is well connected to regional markets.

Based on these strengths, there are a variety of opportunities that Sri Lanka and Bangladesh could pursue in order to foster greater bilateral relations. Firstly, based on the MoU on Economic Partnership and joint feasibility studies conducted, an FTA can be formulated and subsequently formalized. Although the two countries are members of SAFTA and APTA, contribution to bilateral trade under these agreements is low, which further emphasizes the need for the establishment of a comprehensive FTA. Bangladesh has only signed one bilateral preferential trade agreement with Bhutan,63 which is indicative of Bangladesh’s willingness to boost bilateral economic relations with neighboring countries. This is a key opportunity for Sri Lanka, which could additionally be the first partner for an FTA and pave the way for future FTAs.

Following previous trends of growing per capita income, an expanding middle class and increasing consumption in Bangladesh, Sri Lanka also has the opportunity to boost exports, particularly consumer goods (which accounted for 25% of Bangladesh’s imports from Sri Lanka in 201564) to the Bangladeshi market. Furthermore, the two countries could build upon strong existing connectivity and the MoU in shipping, and finalize the pending Coastal Shipping Agreement, which would help improve economic integration. It would also provide Sri Lankan vessels with third party access to ports in East India.65 Such an agreement would also help promote Sri Lanka’s MCC services and attract investment from Bangladesh. Furthermore, it could create new sectors for collaboration including Bangladesh’s nascent shipbuilding industry.66

As global supply chains shift away from China following the COVID-19 pandemic in an attempt to diversify risks, there lies an opportunity for Bangladesh and Sri Lanka’s garment sectors to increase sales to western markets. Additionally, leadership of the BGMEA has highlighted the importance of regional cooperation in the industry during this time,67 indicating Bangladesh’s willingness to work collaboratively.

Despite Sri Lanka’s popularity as a tourist destination, the country receives a small share of Bangladesh’s tourism. While the current COVID-19 pandemic poses challenges to strengthening this aspect of the countries’ relationship, focusing on drawing tourism from within the region, including from Bangladesh, could be beneficial to the revitalization of the tourism sector when it is safe to open borders.

4.2 Weaknesses and Threats

In order to reap the benefits presented by the above opportunities, existing weaknesses must be recognized and addressed. There is an existing imbalance between bilateral FDI flows due to limited outward investment from Bangladesh. Furthermore, Bangladesh’s total FDI outflows have declined since 2017 and are currently negative. Due to this incentivizing Bangladeshi investment into Sri Lanka could be challenging.

The health and economic costs incurred due to the pandemic may also threaten bilateral economic integration, as country’s may shift their focus inwards to manage consequences, thereby postponing bilateral cooperation.

Below listed are policy recommendations allowing to take advantage of the aforementioned opportunities:

Bangladesh’s rapid growth and development has been significant, particularly within the South Asian region, and has created several opportunities for stronger links with Sri Lanka. The two countries share well-established and multifaceted ties, built on the foundation of friendly diplomatic relations, geographical proximity, and shared experiences as notable players in the global garment industry. The formalization of Sri Lanka and Bangladesh’s relations, with regards to bilateral trade, investment, and maritime connectivity is imperative to fostering stronger links. This can be achieved through combined efforts between state governments, industrial chambers, and private and public sector officials, and by building on the groundwork laid by previous proposals, dialogue, and MoUs.

1World Bank. (2020). World Bank Open Data. [Online] Available at: https://data.worldbank.org/ [Accessed 20 August 2020].

2Ibid.

3Goldman Sachs. (2007). Beyond the BRICS: Look at the ‘Next 11’. [Online] Available at: https://www.goldmansachs.com/insights/archive/archive-pdfs/brics-book/brics-chap-13.pdf [Accessed 20 August 2020].

4Ibid.

5Islam, S. (1984). ‘The State in Bangladesh under Zia (1975-81)’. Asian Survey. 24(5): 556-573. [Online] Available at: https://www.jstor.org/stable/2644413?seq=1 [Accessed 20 August 2020].

6Dhaka Tribune (2019). Apparel sector’s contribution to GDP going down for years. [Online] Available at: https://www.dhakatribune.com/business/2019/04/26/apparel-sector-s-contribution-to-gdp-going-down-for-years

[Accessed 20 August 2020].

7WTO. (2020). World Trade Statistical Review 2020 – Statistical Tables. [Online] Available at: https://www.wto.org/english/res_e/statis_e/wts2020_e/wts2020chapter06_e.pdf [Accessed 20 August 2020].

8Latest available data.

9World Bank. (2020). World Bank Open Data – Poverty headcount ratio at US $1.90 PPP a day. [Online] Available at: https://data.worldbank.org/ [Accessed 20 August 2020].

10Ibid.

11PWC. (2019). Destination Bangladesh. [Online] Available at: https://www.pwc.com/bd/en/assets/pdfs/research-insights/2019/destination-bangladesh.pdf [Accessed 20 August 2020].

12ADB. (2020). Economic indicators for Bangladesh. [Online] Available at: https://www.adb.org/countries/bangladesh/economy [Accessed 20 August 2020].

13IMF. (2020). Bangladesh – IMF Country Report No. 20/187. [Online] Available at: https://www.imf.org/~/media/Files/Publications/CR/2020/English/1BGDEA2020001.ashx [Accessed 23 August 2020].

14ADB. (2020). Developing Asia to Grow Just 0.1% in 2020. [Online] Available at: https://www.adb.org/news/developing-asia-grow-just-0-1-2020-adb#:~:text=The%20subregional%20economy%20is%20forecast,to%201.6%25%20growth%20in%202021.&text=In%202021%2C%20inflation%20is%20expected,efforts%20to%20eradicate%20extreme%20poverty. [Accessed 20 August 2020].

15IMF. (2020). World Economic Outlook. [Online] Available at: https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD [Accessed 25 August 2020].

16Ministry of Foreign Relations, Sri Lanka. (n.d.). Sri Lanka Missions. [Online] Available at: https://www.mfa.gov.lk/missions/sri-lanka-missions-overseas/south-asia/india/ [Accessed 10 July 2020].

17Bangladesh High Commission, Colombo. (n.d.). General Information. [Online] Available at: http://archive.bhccolombo.lk:8080/bhcc/page/consular_info [Accessed 20 August 2020].

18Dhaka Tribune. (2017). Bangladesh, Sri Lanka sign 14 instruments. [Online] Available at: https://www.dhakatribune.com/bangladesh/foreign-affairs/2017/07/14/pm-hasina-sirisena-hold-bilateral-talks

[Accessed 20 August 2020].

19DNA. (2007). Bangladesh to donate Buddha hair relic to SL. [Online] Available at: https://www.dnaindia.com/world/report-bangladesh-to-donate-buddha-hair-relic-to-sl-1109998 [Accessed 20 August 2020].

20News.lk. (2015). Sri Lanka donates Buddha Statues to Reconstructed Temples in Bangladesh. [Online] Available at: https://www.news.lk/news/sports-travel/item/7249-sri-lanka-donates-buddha-statues-to-reconstructed-temples-in-bangladesh

[Accessed 20 August 2020].

21BIMSTEC. (n.d.). Areas of Cooperation. [Online] Available at: https://bimstec.org/?page_id=199 [Accessed 28 August 2020].

22Presidential Secretariat. (2020). Sri Lanka to Host BIMSTEC in September. [Online] Available at: https://www.presidentsoffice.gov.lk/index.php/2020/03/04/sri-lanka-to-host-bimstec-in-september/?lang=en [Accessed 28 August 2020].

23Ministry of Foreign Affairs. (2019). Foreign Minister Marapana attends Third IORA Blue Economy Conference in Dhaka, Bangladesh. [Online] Available at: https://mfa.gov.lk/foreign-minister-marapana-attends-third-iora-blue-economy-conference-in-dhaka-bangladesh/. [Accessed 28 August 2020].

24SLBCCI. (n.d.). Our Vision. [Online] Available at: www.slbcci.org [Accessed 20 August 2020].

25Ministry of Foreign Affairs. (2017). Joint Statement during the State Visit of the President of Sri Lanka to Bangladesh: 15 July 2017. [Online] Available at: https://mfa.gov.lk/js-b/ [Accessed 28 August 2020].

26Sri Lanka Apparel. (2018). Sri Lanka – Bangladesh FTA Soon: Minister. [Online] Available at: https://www.srilankaapparel.com/sri-lanka-bangladesh-fta-soon-minister/[Accessed 20 August 2020].

27Ibid.

28Department of Commerce. (n.d). South Asian Free Trade Area (SAFTA). [Online] Available at: http://www.doc.gov.lk/index.php?option=com_content&view=article&id=32&Itemid=157&lang=en [Accessed 20 August 2020].

29UN. (2018). Leaving the LDC category: Booming Bangladesh prepares to graduate. [Online] Available at: https://www.un.org/development/desa/capacity-development/2018/04/10/leaving-the-ldc-category-booming-bangladesh-prepares-to-graduate/ [Accessed 28 August 2020].

30Department of Commerce. (n.d). Asia – Pacific Trade Agreement (APTA). [Online] Available at: http://www.doc.gov.lk/index.php?option=com_content&view=article&id=33&Itemid=158&lang=en [Accessed 20 August 2020].

31WTO. (2016). Trade Policy Review of Sri Lanka – Report by the Secretariat. [Online] Available at: https://www.wto.org/english/tratop_e/tpr_e/s347_e.pdf [Accessed 28 August 2020].

32IMF. (2020). Direction of Trade Statistics – Exports and Imports by Area and Countries. [Online] Available at: https://data.imf.org/regular.aspx?key=61013712 [Accessed 20 August 2020].

33IMF. (2020). Direction of Trade Statistics – Exports and Imports by Area and Countries. [Online] Available at: https://data.imf.org/regular.aspx?key=61013712 [Accessed 20 August 2020].

34Ibid.

35Ibid.

36ITC. (2020). Trade Map. [Online] Available at: https://www.trademap.org/ [Accessed 20 August 2020].

37Latest available data.

38Ibid.

39DailyFT. (2019). US-China trade war offers SL apparel rich opportunity: Expert. [Online] Available at:http://www.ft.lk/front-page/US-China-trade-war-offers-SL-apparel-rich-opportunity-Expert/44-688041 [Accessed 20 August 2020].

40Sri Lanka Apparel. (2018). Sri Lanka – Bangladesh FTA Soon: Minister. [Online] Available at: https://www.srilankaapparel.com/sri-lanka-bangladesh-fta-soon-minister/[Accessed 20 August 2020].

41The Daily Star. (2020). Lankans look for direct investment. [Online] Available at: https://www.thedailystar.net/business/news/lankans-look-direct-investment-1856830 [Accessed 28 August 2020].

42Ibid.

43Global Times. (2020). Bangladesh’s RMG export in April declines nearly 85 per cent. [Online] Available at: https://www.globaltimes.cn/content/1187514.shtml [Accessed 20 August 2020].

44Just Style. (2020). COVID-19 has taken its toll on Sri Lanka clothing sector. [Online] Available at: https://www.just-style.com/analysis/covid-19-has-taken-its-toll-on-sri-lanka-clothing-sector_id138909.aspx [Accessed 20 August 2020].

45The Financial Express. (2017). Sailing from Bangladesh to Sri Lanka along the coastline. [Online] Available at: https://thefinancialexpress.com.bd/views/sailing-from-bangladesh-to-sri-lanka-along-the-coastline [Accessed 20 August 2020].

46Nikkei Asian Review. (2015). Sri Lanka challenges Bangladesh on textiles. [Online] Available at:https://asia.nikkei.com/Business/Sri-Lanka-challenges-Bangladesh-on-textiles [Accessed 20 August 2020].

47Sri Lanka Apparel. (2018). Sri Lanka – Bangladesh FTA Soon: Minister. [Online] Available at: https://www.srilankaapparel.com/sri-lanka-bangladesh-fta-soon-minister/ [Accessed 20 August 2020].

48SLTDA. (2019). Monthly Tourist Arrivals Reports – December 2019. [Online] Available at: https://sltda.gov.lk/monthly-tourist-arrivals-reports-2019 [Accessed 20 August 2020].

49World Bank. (2020). World Bank Open Data – International tourism, number of departures. [Online] Available at: https://data.worldbank.org/ [Accessed 20 August 2020].

50PWC. (2019). Destination Bangladesh. [Online] Available at: https://www.pwc.com/bd/en/assets/pdfs/research-insights/2019/destination-bangladesh.pdf [Accessed 20 August 2020].

51Bangladesh High Commision in Colombo. (n.d.). Investment in Bangladesh. [Online] Available at: http://archive.bhccolombo.lk:8080/bhcc/page/investment_bangladesh[Accessed 20 August 2020].

52Dhaka Tribune. (2017). Bangladesh, Sri Lanka sign 14 instruments. [Online] Available at: https://www.dhakatribune.com/bangladesh/foreign-affairs/2017/07/14/pm-hasina-sirisena-hold-bilateral-talks [Accessed 20 August 2020].

53Bangladesh Investment Development Authority. (2020). Foreign Direct Investment (FDI) in Bangladesh – Survey Report July-December, 2019. [Online] Available at: https://www.bb.org.bd/pub/halfyearly/fdisurvey/fdisurveyjuldec2019.pdf [Accessed 20 August 2020].

54US Department of State. (2019). Investment Climate Statements: Sri Lanka. [Online] Available at:https://www.state.gov/reports/2019-investment-climate-statements/sri-lanka/ [Accessed 20 August 2020].

55UNCTAD. (2020). World Investment Report 2020 Country Fact Sheet: Sri Lanka. [Online] Available at: https://unctad.org/sections/dite_dir/docs/wir2020/wir20_fs_bd_en.pdf [Accessed 20 August 2020].

56Nikkei Asian Review. (2017). Bangladesh liberalizes outward investment at last. [Online] Available at: https://asia.nikkei.com/Economy/Bangladesh-liberalizes-outward-investment-at-last [Accessed 20 August 2020].

57UNCTAD. (2020). World Investment Report 2019. [Online] Available at: https://unctad.org/en/PublicationsLibrary/wir2019_en.pdf#page=229 [Accessed 20 August 2020].

58Nikkei Asian Review. (2017). Bangladesh liberalizes outward investment at last. [Online] Available at: https://asia.nikkei.com/Economy/Bangladesh-liberalizes-outward-investment-at-last [Accessed 20 August 2020].

59Latest available data. Institute of Policy Studies of Sri Lanka. (2014). Bangladesh-Sri Lanka Trade and Investments make Major Strides. [Online] Available at: https://www.ips.lk/wp-content/uploads/2016/12/the_daily-Star.pdf [Accessed 20 August 2020].

60Llyod’s List. (2020). One Hundred Container Ports. [Online] Available at: https://lloydslist.maritimeintelligence.informa.com/one-hundred-container-ports-2020 [Accessed 25 August 2020].

61Daily Mirror (2018). SL and B’desh to sign Coastal Shipping Agreement shortly. [Online] Available at: http://www.dailymirror.lk/article/SL-and-B-desh-to-sign-Coastal-Shipping-Agreement-shortly–156546.html [Accessed 20 August 2020].

62UNCTAD. (2020). UNCTADStat – Liner shipping bilateral connectivity index. [Online] Available at: https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96618 [Accessed 20 August 2020].

63Dhaka Tribune. (2020). Bangladesh signs preferential trade agreement with Bhutan. [Online] Available at: https://www.dhakatribune.com/bangladesh/2020/12/06/bangladesh-signs-preferential-trade-agreement-with-bhutan [Accessed 4 January 2021].

64Latest available data. IMF. (2015). World Integrated Trade Solution. [Online] Available at:https://wits.worldbank.org/CountryProfile/en/Country/BGD/Year/2015/TradeFlow/Import/Partner/LKA/Product/All-Groups [Accessed 28 August 2020].

65Daily Mirror (2018). SL and B’desh to sign Coastal Shipping Agreement shortly. [Online] Available at: http://www.dailymirror.lk/article/SL-and-B-desh-to-sign-Coastal-Shipping-Agreement-shortly–156546.html [Accessed 20 August 2020].

66Dhaka Tribune. (2018). Bangladesh gaining global recognition as a shipbuilding nation. [Online] Available at: https://www.dhakatribune.com/business/2018/05/25/bangladesh-gaining-global-recognition-as-a-shipbuilding-nation [Accessed 20 August 2020].

67Fibre2Fashion. (2020). Fibre2Fashion webinar moots India-Bangladesh collaboration. [Online] Available at: https://www.fibre2fashion.com/news/company-news/textile-news/textile-stakeholders-moot-india-bangladesh-collaboration-267840-newsdetails.htm?amp=true [Accessed 28 August 2020].

68Institute of Policy Studies of Sri Lanka. (2009). Making SAFTA Effective: An Approach to Prune Sensitive Lists in South Asia. [Online] Available at: https://www.ips.lk/making-safta-effective-an-approach-to-prune-sensitive-lists-in-south-asia/ [Accessed 20 August 2020].

69World Bank. (2020). Ease of Doing Business rankings. [Online] Available at: https://www.doingbusiness.org/en/rankings?region=south-asia [Accessed 20 August 2020].

*Nikhita Panwar is a former off-site Research Assistant at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI) in Colombo. The author acknowledges with appreciation comments by Angela Huettemann, former Research Fellow at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI) in Colombo. The opinions expressed in this piece are the author’s own and not the institutional views of LKI, and do not necessarily reflect the position of any other institution or individual with which the author is affiliated.