July 15, 2020 Reading Time: 22 minutes

Reading Time: 22 min read

Image Credits: Maria Stewart/Unsplash

*Chathuni Pabasara

Sri Lanka’s diplomatic engagement with the Association of Southeast Asian Nations (ASEAN) began after independence and has since expanded significantly. Economic ties between Sri Lanka and ASEAN have strengthened over the last two decades, and yet, there remains great potential for deeper engagement through trade, investment and tourism.

This LKI Policy Brief will review the existing historic, diplomatic and economic relations between Sri Lanka and ASEAN economies, and employ a Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis to evaluate the current state of bilateral relations between Sri Lanka and ASEAN and propose ways in which Sri Lanka can leverage on its existing economic ties with ASEAN in a post COVID-19 world.

ASEAN is an intergovernmental organization of 10 member states in Southeast Asia: Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Laos, Myanmar, Cambodia, and Vietnam. With a combined population of over 640 million people 1, ASEAN is the 3rd largest market in the world in terms of population, accounting for approximately 8.6% of the world population. In 2018, the combined GDP of ASEAN was USD 2.96 trillion, 2,3 and it is collectively ranked as the 5th largest economy in the world.4 Additionally, ASEAN is ranked as the 3rd largest trade bloc in the world, after the European Union and the North American Free Trade Agreement.

As the world faces the worst economic downturn since the great depression, ASEAN economies have been hit hard by the economic crisis triggered by the COVID-19 pandemic. The virus has prompted varied responses across the region to mitigate the effects of the crisis. Proactive government responses in countries like Vietnam have been lauded globally for their effectiveness in containing the virus, other ASEAN member states continue to witness growing numbers of confirmed COVID-19 cases.5 And while it is too early to measure the vast economic toll of the pandemic due to its evolving nature, lives, and livelihoods have been upended in all parts of the region as a result of the restrictions placed on economic activities to curb the spread of the virus. The IMF World Economic Outlook Update, June 2020 projects a sharp decline in regional growth with the ASEAN-5 (Indonesia, Malaysia, Philippines, Thailand, and Vietnam) growth at -2.0 percent in 2020.6 But despite the pessimistic forecast for 2020, ASEAN-5 economies are expected to bounce back stronger with a projected growth rate of 6.2% in 2021,7 exceeding those of other emerging markets and developing economies (with the exception of China). However, there remains extreme uncertainty around the strength of the recovery given the nature of the crisis.

Sri Lanka has successfully deepened its economic ties with ASEAN nations over time, with bilateral trade growing from USD 2,155 million in 2009 to USD 4,487 million in 2019 (+108%).8 Sri Lanka’s major exports to the region comprise of apparel, electrical machinery, natural pearls and tea, while mineral fuels and oils, rubber, and machinery are Sri Lanka’s main imports from the region. However, despite a growing influx of investment and tourism from ASEAN, flows from the region only account for a small proportion of investment and tourism, highlighting significant potential for a stronger relationship between Sri Lanka and ASEAN. Figure 1 provides a brief summary of the potential behind a deeper relationship between Sri Lanka and ASEAN nations.

ASEAN was established on 8 August 1967 following the signing of the ASEAN declaration in Bangkok, Thailand by the founding members of ASEAN; Indonesia, Malaysia, Philippines, Singapore, and Thailand.9 The alliance was formed during the tensions of the Cold War to promote regional stability and cooperation. ASEAN strives towards achieving sustainable economic growth, while maintaining peace and stability in the South East Asian region as one of the most dynamic regions in the world.

Contact between Sri Lanka and South East Asia dates back to as early as the 5th century due to extensive maritime trade between the East and the West, forming a network of trade routes and ports that connected Sri Lanka to Indonesia, Thailand, and Vietnam.10 Sri Lanka’s first diplomatic ties with the region were established with Myanmar, initiated by Sri Lankan King Vijayabahu I (1055-1110) with Burmese King Anawrahta (1044-1077) through the exchange of envoys.11 Vijayabahu I also received economic aid during the war against the Cholas and assistance in re-establishing the Sangha in Sri Lanka following the expulsion of the Cholas from King Anawrahta.

The shared commitment towards Theravada Buddhism continued to serve as a link between Sri Lanka and Myanmar, through the frequent exchange of pilgrims and religious scriptures fostering closer ties between the two countries over the centuries. The historical relations of Sri Lanka with Cambodia, Laos, and Thailand were similarly founded on Buddhism and was fostered by the spread of Buddhist literature, philosophy and architecture by Sri Lankan missionaries visiting the region.

Indonesian political exiles were sent to Sri Lanka during the 17th century as both Sri Lanka and Indonesia fell under the colonial rule of the Dutch.12 The Sri Lankan Malays, descended from ancestors who arrived in Sri Lanka from the Malayan Peninsula and the Indonesian archipelago, during the Dutch rule, have contributed to local culture through their vibrant cuisine, pastimes, and clothing.

Since independence, Sri Lanka has proactively engaged with ASEAN member states through various multilateral fora and regional initiatives. The Bandung Conference of 1955 held in Indonesia, was co-sponsored by newly independent governments in Asia, including those of Sri Lanka, Indonesia, and Myanmar. The conference served as a precursor to the establishment of the Non-Aligned Movement and has been chaired by leaders of Sri Lanka, Indonesia, and Malaysia.

Diplomatic missions are one of the most crucial actors of economic diplomacy and Sri Lanka’s strong diplomatic presence in the region is an indication of the capacity to promote Sri Lanka’s economic interests in the region. Sri Lanka has seven resident missions in Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam, and two honorary consuls for Laos PDR and Brunei Darussalam, accredited from the resident Missions in Thailand and Singapore, respectively.13 Diplomatic relations between Sri Lanka and Myanmar were established in 194914 with the opening of the Sri Lankan mission in Yangon, making it one of the very first overseas missions opened by Sri Lanka after independence. Sri Lanka established diplomatic relations with Indonesia in 1948, with initial representation at the level of a Legation in Sri Lanka in 1952. The Sri Lankan Ambassador to Indonesia was accredited to ASEAN in July 2016.15 Sri Lanka’s resident missions of Myanmar, Vietnam, Malaysia and Thailand, and an honorary consulate of Singapore were subsequently opened, while Brunei Darussalam, Lao PDR, and Cambodia are accredited to Sri Lanka through resident missions in New Delhi. (Figure 2).

Figure 2: Diplomatic presence in Southeast Asia

Source: LKI based on information obtained from the Ministry of Foreign Relations of Sri Lanka

Over the recent years, Sri Lankan Presidents and Prime Ministers have undertaken a number of official visits to ASEAN countries,16 including Singapore, Malaysia, Indonesia, Thailand, Cambodia, and the Philippines. Over time, Sri Lanka has received various official visits17 by the Heads of State from Malaysia, Indonesia, Vietnam, Myanmar, Singapore and Thailand, which stands as a to the strong diplomatic ties between Sri Lanka and the region.

Sri Lanka has pursued to strengthen ties with ASEAN on several occasions despite an initial refusal to join ASEAN. At the time of inception in 1967, ASEAN invited Sri Lanka to join the association, with the country’s foreign policy interest aligning well with ASEAN’s anti-communist and pro-Western stance.18 However, Sri Lanka declined the invitation and chose to maintain its commitment to non-alignment. In the 1980s, the country attempted to join ASEAN but was declined by the group. In 2007, Sri Lanka joined the ASEAN Regional Forum (ARF), which is a platform for bilateral and multilateral dialogue and consultation on political and security issues in the Asia Pacific region.19 Sri Lanka also entered into ASEAN’s Treaty of Amity and Cooperation in the same year.

As per the admissions criteria in the ASEAN Charter adopted in 2007,20 non-Southeast Asian countries can no longer become members of ASEAN. That said, they can be granted the status of a Dialogue Partner, Sectoral Dialogue Partner, Development Partner, Observer, or Guest on the grounds of diplomatic relations with the Association. Dialogue Partnerships are the most extensive in terms of the level of engagement, with its agenda comprising of trade and investment, socio-cultural and regional political issues and terrorism and transnational crime. The partnership consists of regular exchanges, ministerial meetings and summit meetings. ASEAN currently has 10 Dialogue Partners, namely Australia, Canada, China, European Union, India, Japan, Republic of Korea, New Zealand, Russia, and the United States.21 Sri Lanka submitted its application for Sectoral Dialogue Partnership in 2019,22 in a renewed attempt to strengthen economic engagement and cooperation with ASEAN and its member countries.

With a population of nearly 640 million people 23 and a combined GDP of USD 2.96 trillion,24 ASEAN is one of the most dynamic and fastest-growing regions in the world. While Sri Lanka has maintained close economic ties with ASEAN, bilateral trade, and investment links have remained concentrated among a few members. The Sri Lanka-Singapore Free Trade Agreement (FTA), signed in 2018, was Sri Lanka’s first FTA with an ASEAN member. Sri Lanka also launched negotiations for an FTA with Thailand in 2018, but its progress remains unclear. However, an increasingly integrated ASEAN and a growing consumer class represents a significant opportunity for Sri Lanka to deepen its economic engagement with the region.

4.1 Trade

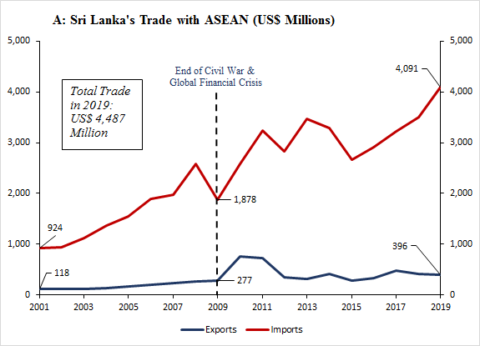

Sri Lanka has experienced a steady, yet limited, growth in trade with ASEAN over the years, with bilateral trade in goods amounting to USD 4,487 million, accounting for 13.4% of Sri Lanka’s total goods traded in 2019. (See Figure 3). As a comparison, Sri Lanka’s bilateral trade in goods with the U.S. amounted to 10% of Sri Lanka’s total goods traded in 2019. Sri Lanka posts a significant trade deficit with the ASEAN region.

Figure 3: Sri Lanka’s Trade with ASEAN (US$ Millions)25

Source: LKI calculations based on IMF Direction of Trade Statistics, Accessed April 2020

Exports to ASEAN amounted to USD 396 million accounting for 4.0% of Sri Lanka’s total exports (Figure 4), compared to imports worth USD 4,091 million from ASEAN which accounted for 17.4% of Sri Lanka’s total imports in 2019.

Figure 4: Share of Trade with ASEAN as a Percentage of Total Exports and Imports26

Source: LKI calculations based on IMF Direction of Trade Statistics, Accessed April 2020

Sri Lanka’s bilateral trade deficit with ASEAN, which amounted to USD 3,695 Million in 2019, is dominated by Singapore and Malaysia. Despite being Sri Lanka’s largest export market in the region, Sri Lanka posted a USD 1,927 million trade deficit with Singapore, followed by a USD 549 million trade deficit with Malaysia, in 2019. Sri Lanka posts a trade deficit with 7 out of the 10 ASEAN countries and maintains a miniscule trade surplus with Lao PDR, Brunei Darussalam, and Cambodia. (See Figure 5).

Figure 5: Sri Lanka’s Goods Trade Balance with ASEAN markets (US$ Millions, 2019)27

Source: LKI calculations based on IMF, Direction of Trade Database, Accessed April 2020

As Sri Lanka’s largest export market in the region, Singapore received USD 143 million worth of goods (roughly 36% of Sri Lankan exports to ASEAN), followed by Vietnam (22% of Sri Lankan exports to ASEAN) in 2019. Sri Lanka’s exports to Singapore comprised mainly of apparel and clothing, electrical machinery and essential oils. (See Figure 6).

Figure 6: Sri Lanka’s Goods Exports to ASEAN Markets (US$ Millions, 2019)28

Note: Data not available for Cambodia.

Source: LKI calculations based on ITC, Trade Map and IMF Direction of Trade Statistics, Accessed April 2020

Singapore is Sri Lanka’s largest source of imports from ASEAN, with Sri Lanka receiving USD 2,069 million worth of goods (50% of imports from the region) in 2019, followed by Malaysia (14% of total imports from the region). A significant amount of imports from Singapore comprise of mineral fuels and mineral oils. (See Figure 7).

Figure 7: Sri Lanka’s Goods Imports from ASEAN Markets (US$ Millions, 2019)29

Source: LKI calculations based on ITC, Trade Map and IMF Direction of Trade Statistics, Accessed April 2020

4.2 Foreign Direct Investment

Sri Lanka has bilateral investment treaties with 5 ASEAN members: Vietnam, Indonesia, Thailand, Malaysia, and Singapore.30 That said, FDI flows from these and other ASEAN countries remain below potential. The total value of FDI received from ASEAN has decreased over time (USD 257 Million in 2016, USD 201 Million in 2017, USD 159 Million in 2018 and USD 152 Million in 2019).31 What is more, ASEAN’s share in relative FDI receipts has declined over time (28.7% in 2016, 14.6% in 2017, 9.9% in 2018).

Nevertheless, in 2019, relative FDI receipts from ASEAN increased to 20% of total FDI receipts, reversing previous trends as Sri Lanka observed a sharp decline in total inward FDI in 2019 from other nations.

Historically, Singapore, Malaysia, and Thailand are Sri Lanka’s key investors among ASEAN members. Singapore has been Sri Lanka’s largest source of FDI in the region, accounting for USD 103 million inward FDI in 2019 (68% of total ASEAN FDI flows, 13.6% of total FDI receipts) and has mainly invested in the real estate, food and beverages, and communications sector in Sri Lanka. Malaysia has invested USD 49 Million in 2019 (32% of total ASEAN FDI flows, 6.5% of total FDI receipts).

There are several successful examples of ASEAN FDI in Sri Lanka and one such example is Asia Pacific Breweries, a Singapore-based joint venture between Heineken International and Fraser and Neave, invested in United Breweries Ltd. in Sri Lanka, changing its name to Asia Pacific Brewery (Lanka) Ltd.32 Lanka Communication Services (Pvt) Ltd, a subsidiary of Singapore Telecom, received the first Telecommunications Operator License in Sri Lanka following the liberalization of the Sri Lankan telecommunications sector, and continues to be a pioneer in the provision of data communications and internet services in the country.33 Overseas Realty (Ceylon) PLC (ORCL) is an investment and property development company, incorporated in Sri Lanka in 1980 as a Board of Investment flagship company. Shing Kwan Group, a Singapore-based real estate company, holds 61% of the existing issued share capital of ORCL. One of ORCL’s most prominent projects is the World Trade Center, Colombo. The company is currently developing Havelock City, one of the largest mixed-use real estate projects in the country.34

Hyrax Oil Sdn Bhd, a Malaysian-based oil and petroleum derivatives manufacturer, opened a blending plant in Sri Lanka in 2019. The USD 30 Million investment will manufacture lubricants for 20 years for the Ceylon Petroleum Corporation and is expected to earn USD 60 Million per annum.35

While comprehensive outward FDI data is not available, Sri Lankan outward FDI in ASEAN remains concentrated in the textile manufacturing and finance sectors in a few ASEAN member states. Sri Lankan investments in the region includes two LEED (Leadership in Energy and Environmental Design) certified textile manufacturing plants by the Hirdaramani Group in Vietnam, with a production capacity of 7 Million pcs per month and 10,000 employees.36 Another Sri Lankan textile manufacturer, MAS Holdings, opened a state-of-the-art manufacturing facility in Vietnam for one of its subsidiaries, Linea Aqua (Pvt) Ltd, as part of its global expansion.37 The LOLC Group, a Sri Lankan leasing company, made its first overseas investment in Cambodia. The company acquired 60% of shares in Thanakea Phum (Cambodia) Ltd. in 2014 and is the 5th largest regulated microfinance institution in Cambodia. The group also successfully obtained a license to establish and operate a deposit-taking institution in Myanmar in 2013. The presence of Sri Lankan firms in the ASEAN region is an indication of the dynamism of Sri Lankan firms and their aspiration to compete in new markets, even in countries with no Sri Lankan diplomatic presence (Cambodia). Outward investments are not just a gateway to new markets, but also to new foreign technology and business processes.

4.3 Tourism and Migration

ASEAN’s growing middle class and its increasing levels of disposable income makes it an extremely vital source of tourists with greater spending power. However, Sri Lanka only received 60,102 tourists from ASEAN in 2019, accounting for just 3.1% of total arrivals in 2019.

Malaysia was Sri Lanka’s largest source of tourists in 2019, accounting for 16,861 tourists (28% of tourists from ASEAN), followed by 14,590 and 13,871 arrivals from the Philippines (24%) and Singapore (23%), respectively.38 Sri Lanka has historically received low numbers of tourists from the region, with a 4.19% average share in tourist arrivals from ASEAN between 2014 and 2019. Sri Lanka’s failure to attract a sizable number of tourists from the region despite good air connectivity and short flight times, suggests the lack of marketing efforts targeting countries with high outbound tourist flows.

In terms of outward migration,39 3,870 Sri Lankans departed for employment in the region in 2017,40 accounting for 1.8% of total foreign employment departures from Sri Lanka.41 Malaysia received the highest number of Sri Lankans (1,995 workers) accounting for 52% of total departures to the ASEAN region, closely followed by Singapore (1,789). A majority of departures to Malaysia consisted of skilled and unskilled level workers, while departures to Singapore consisted of unskilled, professional, and housemaid level workers.

Large-scale lockdowns, travel restrictions, and social distancing have resulted in a sharp fall in consumer spending and business activity. And while the future in a post COVID-19 world remains filled with uncertainty and economic challenges, the crisis also presents an opportunity for Sri Lanka to reevaluate its relationship with ASEAN as there remains much room for stronger bilateral engagement. Therefore, a Strengths, Weaknesses, Opportunities, and Threats Analysis (SWOT) can be a useful tool in discussing internal as well as external factors influencing Sri Lanka’s attempt for deeper engagement with ASEAN.

Figure 8: SWOT Analysis of Sri Lanka-ASEAN Ties

5.1 Strengths and Opportunities

Sri Lanka maintains diplomatic missions in all ASEAN member states, with the exception of Cambodia, and enjoys rich cultural and historical ties with the region. Given the uncertain nature of the current economic environment, missions can monitor market trends and changes in demand in their respective markets and relay vital information on trade and investment opportunities to Sri Lankan companies seeking to expand their businesses overseas. Such information can especially be useful for small and medium enterprises (SMEs) with no experience in exporting. While diplomatic missions play an important role in the promotion of trade and investment, they also provide political support to local firms when entering and operating in foreign markets, which is sometimes a necessity for companies to succeed in certain countries.

Despite being a platform for political and security issues, Sri Lanka’s membership in the ASEAN Regional Forum is likely to facilitate Sri Lanka’s application for Sectoral Dialogue Partnership and enhance its overall engagement and integration with ASEAN.

Southeast Asia is located at the strategic crossing of the Indian Ocean and the South China Sea and with the bulk of its international trade carried by sea, ASEAN members have invested heavily in the development of high-quality transport and port infrastructure, lowering their trade costs. The Master Plan on ASEAN Connectivity 2025 strives to integrate poorly connected countries like Cambodia, Laos, Myanmar, and Vietnam, and develop a competitive maritime system that would greatly reduce the cost of international trade in these countries. The geographical distance between Sri Lanka and all ASEAN countries is favorably short and therefore facilitates lower shipping costs through established maritime trade routes and air connectivity. ASEAN firms investing in Sri Lanka can likewise benefit from Sri Lanka’s strategic geographic location on the traditional east-west shipping route connecting the East with the Middle East and Europe, facilitating trade between ASEAN and these regions.

While the comprehensive Sri Lanka-Singapore Free Trade Agreement (SLSFTA) facilitates bilateral trade in goods and services through the elimination of tariff and nontariff barriers, it also provides a gateway to the ASEAN market and partners with whom Singapore has FTAs, facilitating Sri Lanka’s integration into regional value chains.42 In deepening its economic ties with ASEAN, Sri Lanka also benefits from established trade and investment links with the region, supported by a strong diplomatic presence in ASEAN member countries.

The rise in the total number of confirmed COVID-19 cases in ASEAN has led to an increase in demand for Personal Protective Equipment (PPE). Certain ASEAN member countries therefore face shortages in much needed PPE as a result of hospitals treating growing numbers of patients and bulk buying habits of the public. While member states facing shortages of PPE have received supplies from the World Health Organization, it is unlikely that assistance from international organizations is able to meet the growing demand for PPE,43presenting PPE manufacturers in Sri Lanka with the opportunity to meet this demand. Apparel is one of Sri Lanka’s main exports to ASEAN, therefore apparel manufacturers who have already reoriented their production lines to cater to a global demand in PPE, can benefit from established trade links with the region.

As much of Europe and the United States continue to battle the COVID-19 pandemic, ASEAN members have outperformed the West in in controlling the crisis despite being deeply bound to China through trade and travel.44 While the economic outlook remains dire due to the uncertain nature of the crisis, ASEAN-5 economies are expected to grow faster than other developing economies (with the exception of China) and several advanced economies at 6.2% in 2021.45 And as Western consumer demand shrinks rapidly amidst continued anxiety and increased restrictions on businesses, Sri Lanka should reduce its reliance on traditional trading partners in the West and diversify its export markets by strengthening its trade and investment links with ASEAN economies to revive exports and build resilience to future adverse shocks.

ASEAN’s middle class is expected to grow to 334 Million by 2030, accounting for 51% of its population,46 and greater levels of disposable income will create a demand for a wide range of goods and services, providing increasing opportunities for Sri Lankan goods exports of tea, coffee, spices, apparel, and services exports such as IT and tourism. Bilateral trade with ASEAN accounted for 13.4% of Sri Lanka’s total goods traded in 201947 and is an indication of established trade links, with significant potential for expansion, in order to capitalize on the growing Southeast Asian consuming middle class.

Greater engagement with ASEAN would not only open up the possibility of a future FTA between Sri Lanka and ASEAN but would also remove trade barriers with its 6 dialogue partners (Australia, People’s Republic of China, India, Japan, Republic of Korea, and New Zealand) with whom ASEAN already has FTAs48 and would also act as a stepping stone for Sri Lanka to the Regional Comprehensive Economic Partnership (RCEP). RCEP is a proposed agreement between ASEAN and its FTA partners.49 The agreement aims to enhance trade and investment linkages, economic cooperation and strengthen regional security and stability, leading to the formation of the world’s largest trade bloc, accounting for 45% of global population and nearly a third of global GDP.50

Rising labor costs and COVID-19 related supply chain disruptions in China have led to the relocation of the labor-intensive manufacturing sector into emerging Southeast Asian economies such as Vietnam.51 This move has allowed ASEAN economies to build new industrial capabilities and integrate into global value chains and several Sri Lankan firms, notably in the textile manufacturing sector, have invested in the ASEAN region and capitalized on its sophisticated manufacturing capabilities and regional production and supply chains. The accessibility to new foreign technology not only benefits the investing firm but also the domestic economy, due to technology and productivity spill overs to local firms. While Sri Lanka has received considerable FDI from ASEAN countries in a variety of sectors, it should aim to attract investments that facilitate the transfer of skills and technology to help build Sri Lanka’s own industrial capabilities.

5.2 Weaknesses and Threats

Despite the abovementioned opportunities, there are a number of weaknesses and threats that need to be addressed in order to realize the full potential of the bilateral relationship. One such weakness is that Sri Lanka’s bilateral trade and investment with ASEAN remains concentrated in Singapore, Malaysia, Indonesia, Vietnam, and Thailand, with limited engagement with the rest of ASEAN despite the presence of diplomatic missions. The reluctance of the private sector to venture into new or non-traditional markets, often due to the lack of information or incentives, is therefore an obstacle standing in the way of greater engagement with the region.

Sri Lanka also posts a trade deficit with 7 of the 10 ASEAN countries, likely due to limited diversification of Sri Lanka’s exports to the region. The absence of FTAs could further exacerbate this deficit as Sri Lankan exporters lack preferential market access to the region (with the exception of Singapore). SMEs are particularly vulnerable to tariff and non-tariff barriers due to limited resources. Trade barriers may therefore discourage firms from entering the highly competitive ASEAN market, forgoing an opportunity to grow their business.

The absence of an attractive investment climate has compromised Sri Lanka’s ability to attract and retain investment to achieve business-led growth. Sri Lanka ranks 99th on the World Bank’s Ease of Doing Business Index,52 performing poorly on dimensions such as registering property, getting credit, enforcing contracts, and resolving insolvency. Regulatory complexities, restrictive land ownership laws, policy uncertainty, and digital skills gaps are critical challenges that need to be addressed through domestic reforms.

The ASEAN FTA has lowered or removed, intra-regional trade barriers among members and will eventually reduce their reliance on foreign imports of goods and services as they subsequently move towards building regional supply chains. Compounded by COVID-19 related supply chain disruptions, this trend towards greater integration and regionalism within Southeast Asia could leave out extra-regional markets like Sri Lanka.

The decline in Sri Lanka’s merchandise exports by 65% in April53 as a result of weakening global demand has reinforced the need for Sri Lanka to diversify its export base and build resilience to economic shocks by reducing its current dependence on the U.S and the European Union, which accounted for 61% of total exports in 2019.54 With the ASEAN-5 projected to bounce back to +6.2% growth in 2021,55 ASEAN offers great potential for Sri Lanka to diversify its export base. As ASEAN grows in economic capacity, develops new industrial capabilities and regional supply chains while forming new cooperative alliances, Sri Lanka needs to assess its bilateral relationship with ASEAN and formulate a strategy to capitalize on the opportunities presented by one of the most dynamic regions in the world.

As consumer behavior changes at an unprecedented rate in the face of COVID-induced uncertainty, it is crucial that exporters are able to monitor and identify market trends and changes in demand to swiftly adapt and restructure Sri Lankan exports to meet the market needs created by COVID-19. Addressing Sri Lanka’s significant trade deficit with all major ASEAN economies should be a long-term priority and requires a rethinking of Sri Lanka’s export strategy to the region. Export diversification strategies can be used to address Sri Lanka’s narrow basket of exports while identifying the demands of ASEAN’s rising middle class. It is also important that Sri Lanka pursues FTAs with key trading partners in ASEAN, in order to minimize trade barriers and gain preferential market access. Sri Lanka is in the process of negotiating an FTA with Thailand, however the current progress of the negotiations remains unclear. Sri Lanka should strive to build its negotiating capacity and institutional capability to secure favorable trade terms that would facilitate the export of a higher volume of a wide range of goods.

The expansion of export volume to the region also involves encouraging an otherwise reluctant private sector to venture into the region. Measures such as export subsidies and reduced tax rates on export earnings, as part of a more comprehensive export incentive scheme, can be used to incentivize current and potential exporters. The specific market opportunities presented by the economically diverse ASEAN region must be considered when formulating a regional export strategy. Coordination between local institutions and diplomatic missions can assist firms in formulating country-specific strategies that take local preferences and cultural sensitivities into consideration. Export Promotion Programs can also relay crucial information on market conditions to potential exporters like SMEs, especially those from less-developed parts of Sri Lanka.

In light of diminishing inward FDI from ASEAN, Sri Lanka should prioritise identifying the needs of ASEAN investors through stakeholder consultation and implement investment policies tailored to the needs of investors. Addressing complexities in Sri Lanka’s business environment that affect all stages of an investment is crucial in enhancing Sri Lanka’s long-term competitiveness as an investment destination. Policy uncertainty must be addressed by setting long-term policy strategies while the government establishes its credibility and commitment to supporting policy continuity. Sri Lanka can address skills gaps through active labor market policies such as training programs that equip Sri Lankans with skills that are in demand in the labour market.

The historically low number of tourist arrivals from ASEAN can be addressed through greater marketing efforts of Sri Lanka’s standing as a popular and globally acknowledged travel destination. Improved levels of disposable income in ASEAN and an ageing population56 is likely to create a demand for emerging services such as wellness tourism, a focus sector highlighted in Sri Lanka’s National Export Strategy.57 Therefore, the Sri Lanka Tourism Development Authority and diplomatic missions should coordinate with the private sector to develop promotional material in local languages and tourism packages, nuanced to reflect the needs of the specific markets.

ASEAN is a regional hub of trade and supply chains and home to a growing consumer class. And as Sri Lanka moves to position itself as an economic hub in the Indian Ocean and diversify its export base and reposition exports to reduce risk in a highly volatile global economy, its bilateral relationship with ASEAN is of tremendous importance. Strengthening economic engagement with ASEAN requires the formulation of a more comprehensive ASEAN- specific strategy and substantial effort on Sri Lanka’s part, to capitalize on the growing economic capacity substantial of Southeast Asia.

1ASEAN Secretariat. (2019). ASEAN Key Figures 2019. Jakarta: ASEAN Secretariat. [Online] Available at: https://www.aseanstats.org/wp-content/uploads/2019/11/ASEAN_Key_Figures_2019.pdf [Accessed 26 March 2020].

2LKI calculations based on: International Monetary Fund. (2020). World Economic Outlook Database. [Online] Available at: https://www.imf.org/external/pubs/ft/weo/2020/01/weodata/index.aspx [Accessed 26 March 2020].

3In comparison, the combined GDP of NAFTA partners was estimated to be USD 23.4 Trillion while the GDP of the EU was estimated to be USD 18.8 Trillion in 2018; World Bank. (2020). GDP Current US$. World Bank Open Data. [Online] Available at: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD [Accessed 11 May 2020].

4HSBC. (2019). Understanding ASEAN countries and opportunities in a snapshot. [Online] Available at: https://www.business.hsbc.com/asean/the-economist-group/asean-country-snapshots [Accessed 26 March 2020].

5Nikkei Asian Review. (2020). Coronavirus latest: Indonesia reports surge in new infections. [Online] Available at: https://asia.nikkei.com/Spotlight/Coronavirus/Coronavirus-Free-to-read/Coronavirus-latest-Indonesia-reports-surge-in-new-infections [Accessed 27 May 2020].

6International Monetary Fund. (2020). World Economic Outlook, June 2020: A Crisis Like No Other, An Uncertain Recovery. [Online] Available at: https://www.imf.org/en/Publications/WEO/Issues/2020/06/24/WEOUpdateJune2020

[Accessed 25 June 2020].

7Ibid.

8 LKI calculations based on: International Monetary Fund. (2020). Direction of Trade Statistics (DOTS). [Online] Available at: https://data.imf.org/?sk=9D6028D4-F14A-464C-A2F2-59B2CD424B85&sId=1390030341854 [Accessed 15 April 2020].

9ASEAN. (2019). Overview. [Online] Available at: https://asean.org/asean/about-asean/overview/ [Accessed 26 March 2020].

10The Island. (2005). Trade and Commerce in ancient and Medieval Sri Lanka. [Online] Available at: http://www.island.lk/2005/09/05/features6.html [Accessed 26 March 2020].

11The Island. (2008). Diplomacy in ancient and medieval Sri Lanka. [Online] Available at: http://www.island.lk/2008/05/03/satmag6.html [Accessed 26 March 2020].

12The News Minute. (2016). Sri Lanka’s Malays and the fight for minority status. [Online] Available at: https://www.thenewsminute.com/article/sri-lankas-malays-and-fight-minority-status-51482 [Accessed 26 March 2020].

13Ministry of Foreign Relations Sri Lanka. (2019). Sri Lanka Missions. [Online] Available at: https://www.mfa.gov.lk/missions/sri-lanka-missions-overseas/east-asia-pacific/china/

[Accessed 26 March 2020].

14Embassy of Sri Lanka Myanmar. (2020). Sri Lanka Embassy in Myanmar. [Online] Available at: http://www.slembyangon.org/ [Accessed 26 March 2020].

15Embassy of Sri Lanka Indonesia. (2017). ASEAN Relations. [Online] Available at: http://srilankaembassyjakarta.com/sri-lankas-ambassador-to-the-asean-presents-letter-of-credence/ [Accessed 26 March 2020].

16Ministry of Foreign Relations Sri Lanka. (2019). President Maithripala Sirisena Concludes a Successful Visit to Singapore. [Online] Available at: https://www.mfa.gov.lk/president-maithripala-sirisena-concludes-a-successful-visit-to-singapore/ [Accessed 26 March 2020]; High Commission of Sri Lanka in Malaysia. (2016). President meets Malaysian King. [Online] Available at: https://slhc.com.my/site/2016/12/16/president-meets-malaysian-king/ [Accessed 26 March 2020]; Ministry of Foreign Relations Sri Lanka. (2017). State Visit of President Maithripala Sirisena to the Republic of Indonesia. [Online] Available at: https://www.mfa.gov.lk/state-visit-of-president-maithripala-sirisena-to-the-republic-of-indonesia/ [Accessed 26 March 2020]; Ministry of Foreign Affairs Kingdom of Thailand. (2016). Press Release. [Online] Available at: http://www.mfa.go.th/main/en/media-center/14/71041-President-of-the-Democratic-Socialist-Republic-of.html [Accessed 26 March 2020]; Ministry of Foreign Relations Sri Lanka. (2019). Sri Lanka-Cambodia Joint Statement. [Online] Available at: https://www.mfa.gov.lk/sri-lanka-cambodia_eng/ [Accessed 26 March 2020]; Ministry of Information and Mass Media. (2019). President returns after four-day state visit to Philippines. [Online] Available at: https://www.media.gov.lk/media-gallery/latest-news/2006-president-returns-after-four-day-state-visit-to-philippines [Accessed 26 March 2020].

17Ministry of Foreign Relations Sri Lanka. (2017). Visit of the Prime Minister of Malaysia to Sri Lanka. [Online] Available at: https://www.mfa.gov.lk/visit-of-the-prime-minister-of-malaysia-to-sri-lanka/ [Accessed 26 March 2020]; Xinhuanet. (2018). Indonesian president arrives in Sri Lanka on state visit. [Online] Available at: http://www.xinhuanet.com/english/2018-01/24/c_136921292.htm [Accessed 26 March 2020]; Daily FT. (2011). Viet Nam President envisions deepening ties with Sri Lanka. [Online] Available at: http://www.ft.lk/opinion/viet-nam-president-envisions-deepening-ties-with-sri-lanka/14-51710 [Accessed 26 March 2020]; Sri Lanka Air Force. (2009). President of Myanmar Senior General Than Shwe visits Sri Lanka. [Online] Available at: http://www.airforce.lk/news.php?news=136 [Accessed 26 March 2020]; Colombo Page. (2018). Singapore PM arrives in Sri Lanka. [Online] Available at: http://www.colombopage.com/archive_18A/Jan22_1516631581CH.php [Accessed 26 March 2020]; Xinhuanet. (2018). Sri Lanka, Thailand to jointly promote Buddhist heritage. [Online] Available at: http://www.xinhuanet.com/english/2018-07/13/c_137322352.htm [Accessed 26 March 2020].

18Eurasia Review. (2011). Sri Lanka: Fresh Insights On Attempts To Join ASEAN – Analysis. [Online] Available at: https://www.eurasiareview.com/27122011-sri-lanka-fresh-insights-on-attempts-to-join-asean-analysis/ [Accessed 26 March 2020].

19Embassy of Sri Lanka Indonesia. (2017). ASEAN Relations. [Online] Available at: http://srilankaembassyjakarta.com/sri-lankas-ambassador-to-the-asean-presents-letter-of-credence/ [Accessed 26 March 2020].

20ASEAN. (2012). The ASEAN Charter. [Online] Available at: https://asean.org/storage/2012/05/3.-November-2019-The-ASEAN-Charter-27th-Reprint_rev-2711191.pdf [Accessed 26 March 2020].

21The Department of ASEAN Affairs. (2014). ASEAN’s External Relations. [Online] Available at: http://www.mfa.go.th/asean/en/organize/62217-ASEAN%E2%80%99s-External-Relations.html [Accessed 26 March 2020].

22Daily FT. (2019). Govt. wants SL included as ASEAN dialogue partner. [Online] Available at: http://www.ft.lk/front-page/Govt-wants-SL-included-as-ASEAN-dialogue-partner/44-683722 [Accessed 26 March 2020].

23Supra note 1.

24Supra note 2.

25LKI calculations based on: IMF Direction of Trade Statistics (DOTS). International Monetary Fund, Supra Note 8.

26LKI calculations based on: IMF Direction of Trade Statistics (DOTS). International Monetary Fund, Supra Note 8.

27LKI calculations based on: IMF Direction of Trade Statistics (DOTS). International Monetary Fund, Supra Note 8.

28LKI calculations based on: IMF Direction of Trade Statistics (DOTS). International Monetary Fund, Supra Note 8; ITC. (2020). Trade Map: Trade Statistics. [Online] Available at: https://www.trademap.org/Index.aspx [Accessed 15 April 2020].

29LKI calculations based on: IMF Direction of Trade Statistics (DOTS). International Monetary Fund, Supra Note 8; ITC. Trade Map: Trade Statistics, Supra Note 28.

30UNCTAD. (2020). Bilateral Investment Treaties (BITs). [Online] Available at: https://investmentpolicy.unctad.org/international-investment-agreements/countries/198/sri-lanka

[Accessed 01 April 2020].

31Central Bank of Sri Lanka. (2020). Annual report 2019. [Online] Available at: https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports/annual-report-2019 [Accessed 04 May 2020].

32Daily FT. (2017). Asia Pacific Brewery (Lanka) changes name to Heineken Lanka. [Online] Available at: http://www.ft.lk/dining/asia-pacific-brewery-lanka-changes-name-to-heineken-lanka/39-598377 [Accessed 26 March 2020].

33LankaCom. (2019). About Us. [Online] Available at: http://www.lankacom.net/about-us.html

[Accessed 26 March 2020].

34ORCL. (2019). Why ORCL. [Online] Available at: http://orcl.lk/inpages/about_us/why_orcl.html [Accessed 26 March 2020].

35Lanka Business Online. (2019). Hyrax Oil lubricant blending plant declared open in Muthurajawela. [Online] Available at: https://www.lankabusinessonline.com/hyrax-oil-lubricant-blending-plant-declared-open-in-muthurajawela/ [Accessed 26 March 2020].

36Hirdaramani. (2019). Hirdaramani Apparel. [Online] Available at: http://www.hirdaramani.com/manufacture-and-product/ [Accessed 26 March 2020].

37Ministry of Foreign Relations Sri Lanka. (2016). Deputy Minister of Foreign Affairs concludes visit to Hanoi, Viet Nam. [Online] Available at: https://www.mfa.gov.lk/deputy-minister-of-foreign-affairs-concludes-visit-to-hanoi-viet-nam/ [Accessed 26 March 2020].

38Sri Lankan Tourism Development Authority. (2020). Tourist Arrivals from All Countries 2019. [Online] Available at: http://www.sltda.gov.lk/sites/default/files/Tourist-Arrivals-From-All-Countries-2019(pdf%20).pdf [Accessed 26 March 2020].

39Comprehensive data on inward migration is not available.

40Sri Lanka Bureau of Foreign Employment. (2017). Annual Statistical Report of Foreign Employment – 2017. [Online] Available at: http://www.slbfe.lk/page.php?LID=1&MID=220

[Accessed 26 March 2020].

41Outward migration to the Middle East accounted for 87% of total foreign employment departures in 2017.

42East Asia Forum. (2018). Is Singapore Sri Lanka’s door to East Asia? [Online] Available at: https://www.eastasiaforum.org/2018/02/15/is-singapore-sri-lankas-door-to-east-asia/

[Accessed 23 May 2020].

43East Asia Forum. (2020). PPE and free trade to better tackle COVID-19 in ASEAN. [Online] Available at: https://www.eastasiaforum.org/2020/05/07/ppe-and-free-trade-to-better-tackle-covid-19-in-asean/ [Accessed 23 May 2020]

44Vietnam Briefing. (2020). How Vietnam Contained COVID-19 and Why its Economy Will Rebound. [Online] https://www.vietnam-briefing.com/news/how-vietnam-sucessfully-contained-covid-19.html/ [Accessed 23 May 2020].

45Supra Note 6.

46US – ASEAN Business Council. (2019). Growth Projections. [Online] Available at: https://www.usasean.org/why-asean/growth [Accessed 26 March 2020].

47LKI calculations based on: IMF Direction of Trade Statistics (DOTS). International Monetary Fund, Supra Note 8.

48ASEAN. (2020). Free Trade Agreements with Dialogue Partners. [Online] Available at: https://asean.org/asean-economic-community/free-trade-agreements-with-dialogue-partners/ [Accessed 26 March 2020].

49India announced its withdrawal in 2019.

50The Diplomat. (2020). What RCEP Means for the Indo-Pacific. [Online] Available at: https://thediplomat.com/2019/12/what-rcep-means-for-the-indo-pacific/ [Accessed 26 March 2020].

51Khanna, P. (2020). South-east Asia rides fourth wave of regional growth. [Online] Financial Times. Available at: https://www.ft.com/content/c33e95f4-6acc-11ea-a6ac-9122541af204

[Accessed 24 May 2020].

52World Bank Group. (2020). Economy Profile Sri Lanka: Doing Business 2020. [Online] Available at:

https://www.doingbusiness.org/content/dam/doingBusiness/country/s/sri-lanka/LKA.pdf

[Accessed 12 May 2020].

53Daily FT. (2020). Merchandise exports fall by 65% in April. [Online] Available at: http://www.ft.lk/front-page/Merchandise-exports-fall-by-65-in-April/44-700540

[Accessed 24 May 2020].

54LKI calculations based on: ITC. Trade Map: Trade Statistics, Supra Note 28.

55Supra Note 6.

56Supra Note 1.

57Export Development Board. (2018). NES Focus Sectors – Wellness Tourism. [Online] Available at: https://www.srilankabusiness.com/national-export-strategy/nes-wellness-tourism.html

[Accessed 11 May 2020].

*Chathuni Pabasara is a Senior Research Assistant at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI) in Colombo. The opinions expressed in this piece are the author’s own and not the institutional views of LKI, and do not necessarily reflect the position of any other institution or individual with which the author is affiliated.